SoFi HK New Joiners’ Guide on Deposit (Non-eDDA Method)

This guide is best for members who created an account with us. It will demonstrate how to fund your SoFi Hong Kong account.

eDDA allows you to top up your balance in the SoFi app instantly without the hassle of uploading the transfer proof, and funds will be available for trading immediately. Please refer to eDDA Instant Deposit Guide to make a deposit at lightning speed.

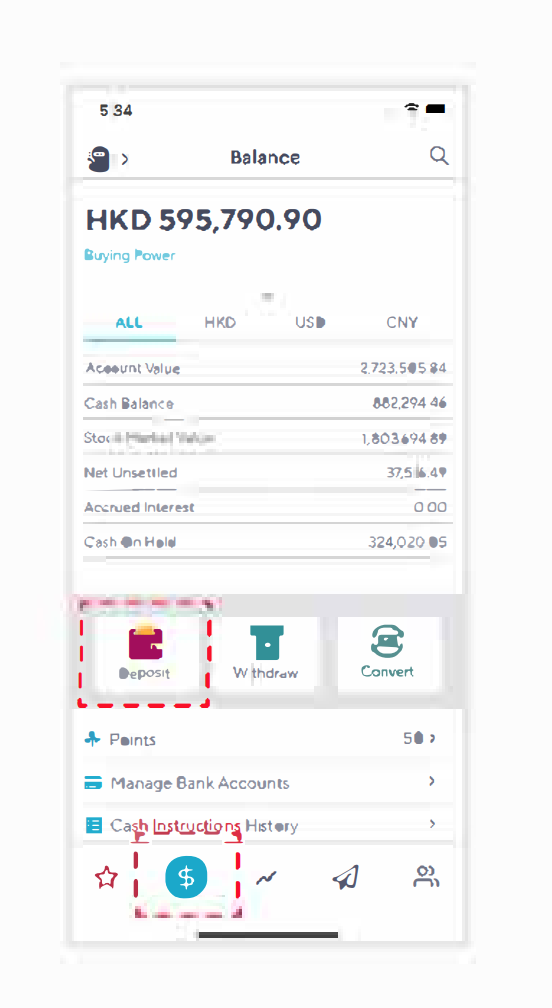

Fund Your SoFi Hong Kong account

Due to the regulatory requirement, you are obligated to transfer funds from your registered bank account to our designated bank account.

Steps

1. Transfer money

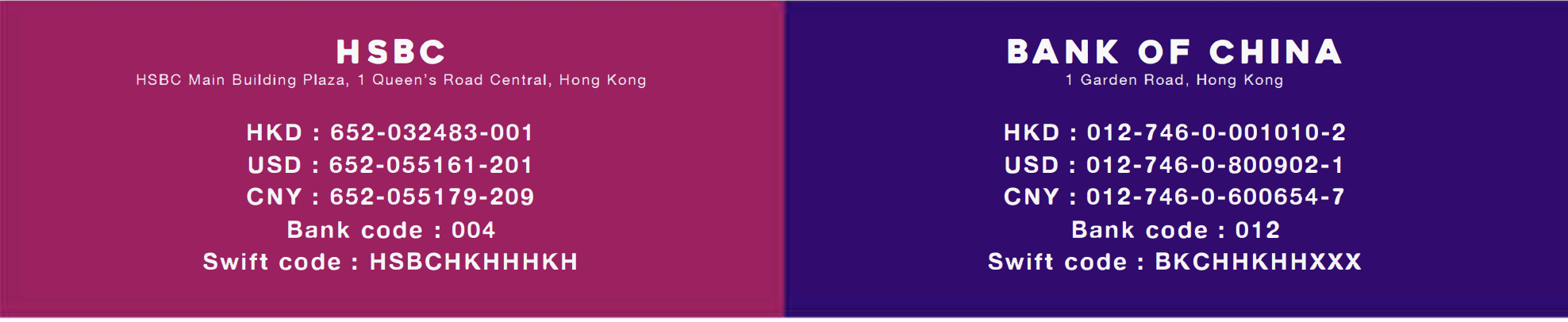

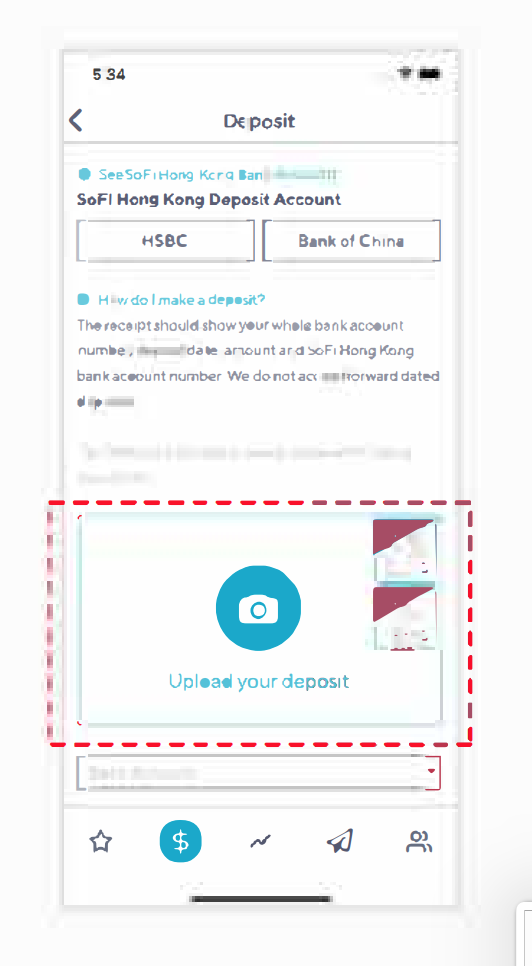

Make a transfer to our bank accounts at HSBC or Bank of China. We only accept transfers in HKD, USD and CNY. Bank charges may apply, please refer to Fees and Charges Table.

Reminder #1

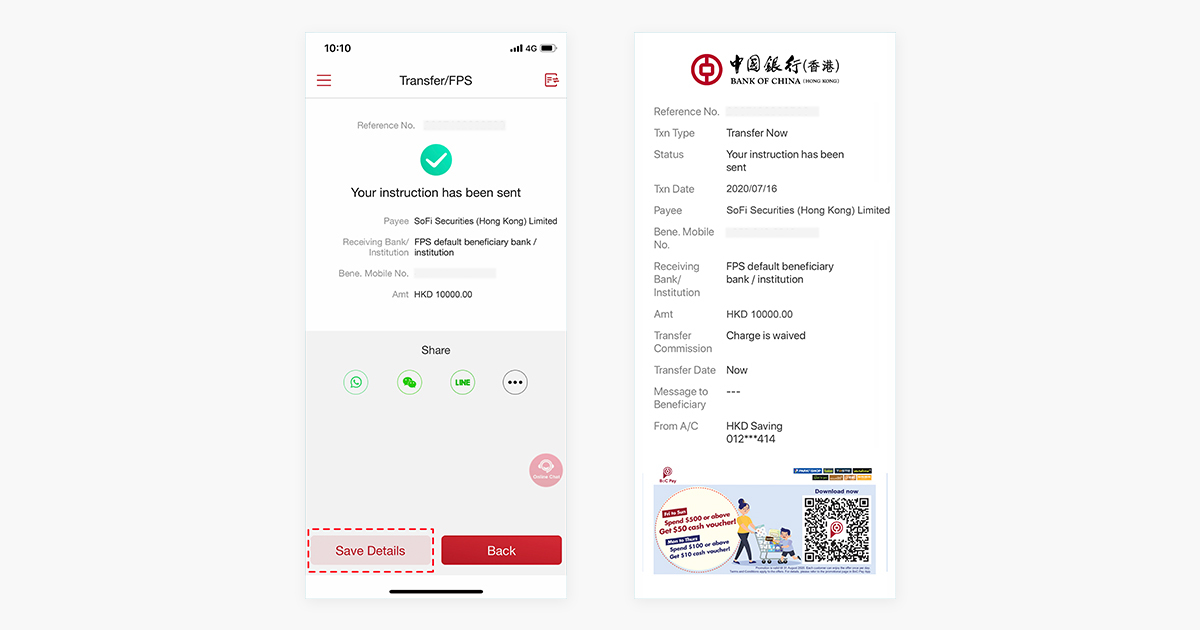

Save Details: The amount, your bank account number, date of transfer, and our account number must be clearly visible.

Reminder #2

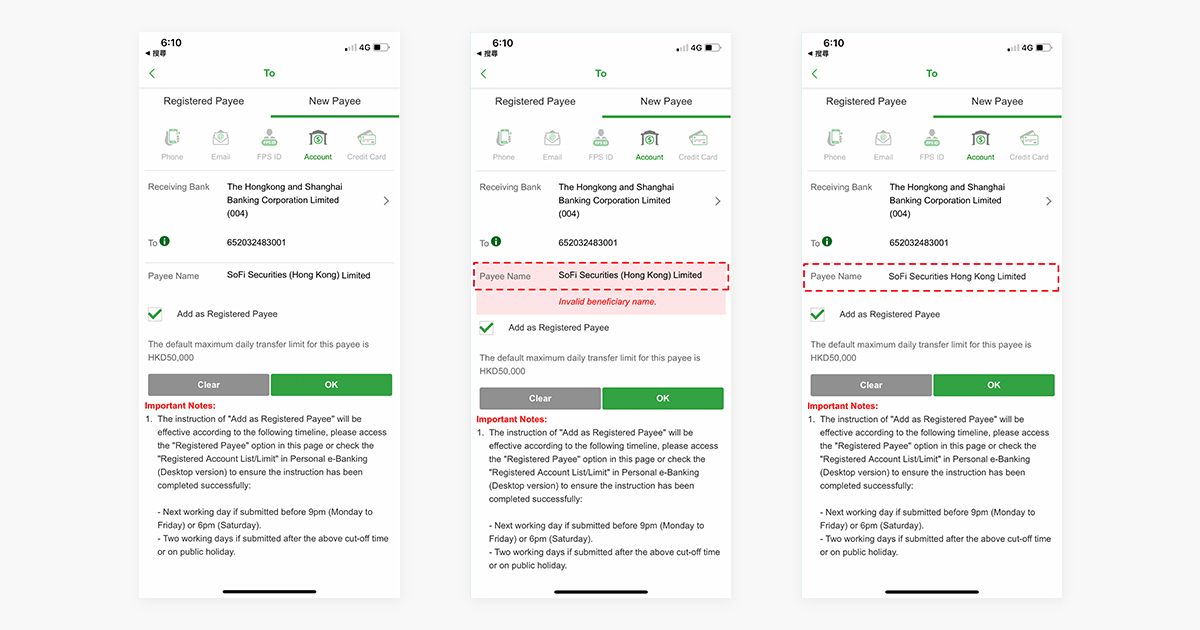

Company PAYEE name: SoFi Securities (Hong Kong) Limited

Remove brackets around the words “Hong Kong” if your bank doesn’t support special characters in the Payee name.

E.g: SoFi Securities Hong Kong Limited

Reminder #3

- No cash deposit (bank notes) at ATM or at bank branch is accepted

- Do not accept transfer from a third party account

- Do not accept transfer from a joint account

- We only accept bank-to-bank transfer

- We don’t support Money Transfer Operator(MTO) – such as TransferWise/InstaReM/OFX

2. Enter transfer details in the app

3. Upload your transfer receipt

Supported methods

Cutoff times

Cash instructions submitted before cutoff times on a working day will be processed on the same day. Details are as follows:

**Notes

- Deposits, withdrawals and refunds will go through applicable anti-money laundering checks which may delay the completion time.

- Actual time needed may vary for different banks.

Add New Bank Account

‘$’ at the bottom of the main screen >> ‘manage bank accounts’ >> ‘add bank accounts’ >> upload bank proof via instructions; customer should deposit HK$10,000/USD$1300 with the registered bank account from your registered Hong Kong licensed bank account(s) to us for the purpose of identity verification as adding new account will go through applicable anti-money laundering checks.

The relevant update will take effect within two working days after confirmation. Please note that SoFi Securities (Hong Kong) Limited does not accept cash/third party deposit. There will be a charge for refunding all relevant deposits. Please refer to the “Cash/Third Party Deposit Return” in the fee table.

Fund Conversion

You can submit a buy order based on your consolidated buying power. It is calculated based on all of the currencies you hold in your brokerage account. If you do not have the sufficient currency balance to settle your trades, you may either submit a fund conversion or make a deposit and notify us through the SoFi Securities (Hong Kong) App. Otherwise; automatic fund conversion will take place at 11:00HKT, one day before settlement date (S-1).

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.