Looking at: Bond Market Drama

Estimated reading time: 0 minutes

On Higher Ground

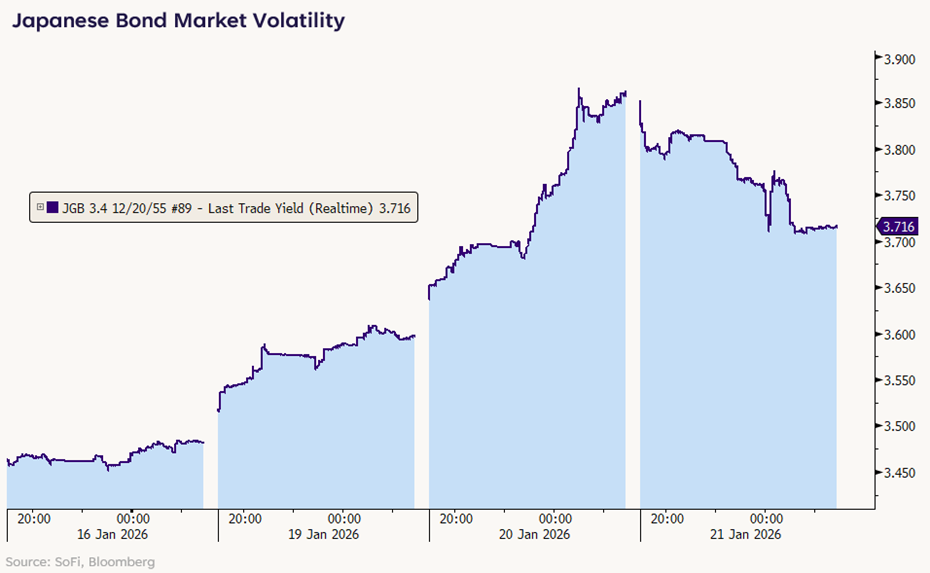

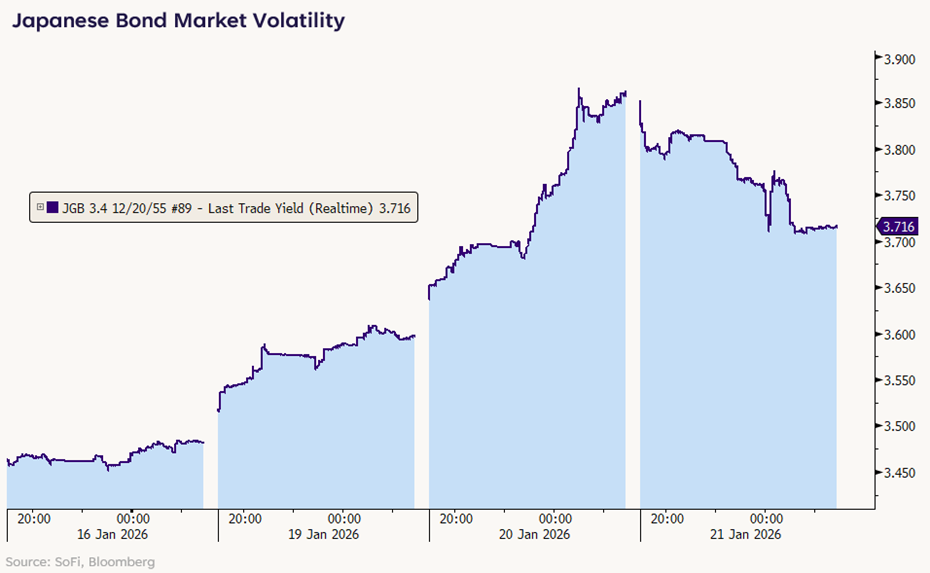

Global markets have been particularly news heavy this week, with the volatility index (VIX) hitting 20 for the first time since November and bond yields in the U.S. and Japan rising dramatically.

The main story was that the Japanese 30-year bond yield rose 27 basis points on Tuesday, its largest one-day rise in history. That move reversed somewhat in Wednesday trading — yields fell by roughly 15 basis points — but market upheaval remains top of mind.

At the same time, business and political leaders from around the globe convened at the World Economic Forum in Davos, Switzerland, to speak on geopolitical topics, capital markets, and economic forces. Despite the headlines out of Davos, many market participants speculated that Japan’s expected spending increases and tax cuts drove the bond moves.

A disconcerting note: There was no clear catalyst for the bond selloff to begin, and no clear reason why the move was so dramatic on one day. Moves of that nature make it difficult for investors to wrap their heads around, which adds to uncertainty and jitters.

U.S. Markets Took a Bruise

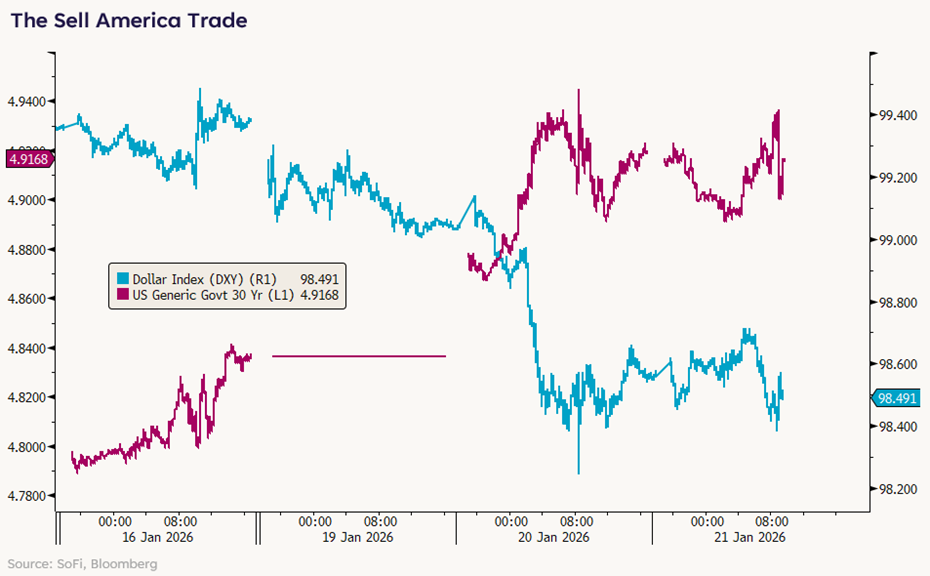

Meanwhile, markets in the U.S. had a rough day Tuesday, partially in response to Japan, partially due to the announcement of possible new tariffs on European countries. Tensions rose over the U.S. pursuit of Greenland, and the Treasury market reacted negatively as speculators feared that tariffs on Europe could push European countries to dump Treasurys in retaliation.

The U.S. dollar also fell as mentions of a “Sell America” trade reverberated around markets.

There’s a lot for investors to digest, and I haven’t even mentioned the stock sell-off that ensued on Tuesday, or the fact that we’re in the midst of fourth-quarter earnings season.

The critical question for stock markets is: Should we more or less ignore the geopolitical headlines and continue to invest based on the positive things we know to be true right now?

We’d say yes. We know these things to be true: Profit margins are healthy, earnings growth is expected to be strong, and markets are broadening out beyond the tech trade. These are all indicators of a friendly investing environment.

Volatile Days Don’t Make Volatile Periods

As investors, it’s challenging to keep our eye on the long-term when there are short-term gyrations in markets. Those hiccups may feel like big deals in the moment, but as we’ve seen many times before, they look like blips on the radar in the rearview mirror.

Last week, we wrote about the good signs in markets. Nothing has materially changed since then. The headline machine will keep churning out juicy news, and I think we can expect that to remain the case for the foreseeable future. Might as well learn to invest alongside it, rather than in constant reaction to it.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.