Decoding Markets: Behavioral Biases

Estimated reading time: 7 minutes

The Threat From Within

2025 has been filled with twists and turns. From trade policy uncertainty to major tax reforms to the ongoing dominance of artificial intelligence, there has been a lot to digest. But complex and sometimes confusing backdrops create a fertile ground for investment mistakes.

When investing over the long-term, the most significant threat often comes from within. Most investors aren’t robots (though even that has been changing these days), which means that behavioral biases inevitably come into the fray. This can contribute to investors making the wrong decisions at precisely the wrong moments.

In a market increasingly dominated by animal spirits, it’s a good time to check ourselves before we wreck ourselves.

Recency Bias

Recency bias causes individuals to weigh recent events more heavily than historical data when making judgments and decisions. In investing, this manifests as the tendency to believe that recent market trends, whether positive or negative, will continue indefinitely into the future. This bias can be particularly potent — our freshest memories are usually the most vivid — and so they seem the most relevant.

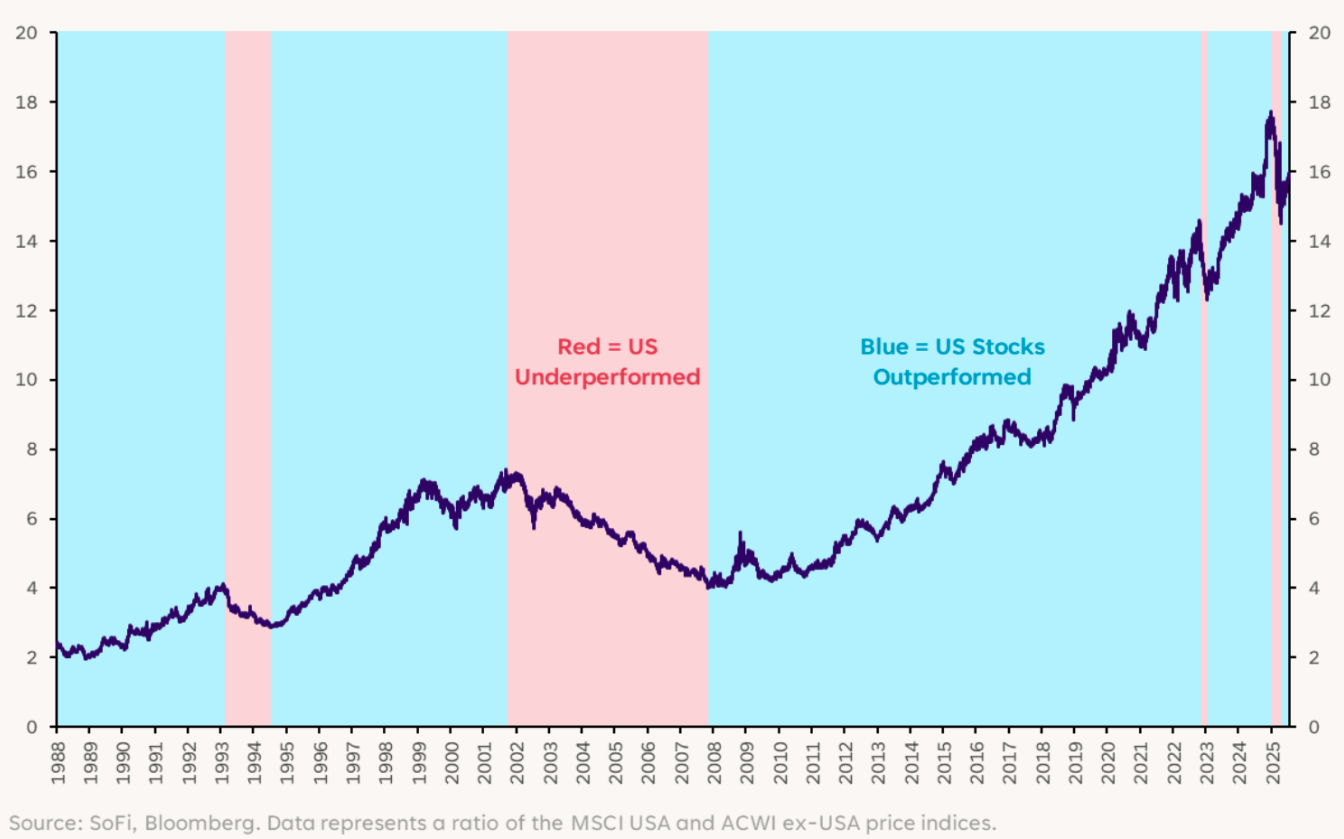

However, this can lead investors to abandon longer-term strategies in favor of chasing hot trends or abandoning underperforming stocks. This year has provided a textbook example of the conditions that foster recency bias. As we discussed last week, the first half of 2025 disrupted the nearly two decades of “U.S. exceptionalism” in stocks, as a dramatic reversal saw the dollar depreciate significantly and international markets surge.

US vs. International Stocks

Here’s where the behavioral trap of recency bias snaps shut. After more than a decade of the U.S. market (particularly tech stocks) being rewarded for being overweight, investors are now confronting the possibility of a new market regime. In response, the psychological pull can be to over-rotate, chasing returns in international markets by selling U.S. assets. Implicit in that decision is the assumption that what we saw in the first half of 2025 is a sign of things to come. Yet as July has shown, that’s not guaranteed. Relative performance has been mixed between regions.

Of course, the pitfalls of recency bias don’t mean that international is not going to outperform. It just means that things are more complicated than that and a decision to invest (or not) in international stocks should be based on more than a glance at year-to-date returns.

Speculative Fervor and FOMO

Market pessimism from earlier this year has given way to optimism, and in some pockets, outright euphoria. With the transition has come a resurgence of speculative fervor reminiscent of the meme stock mania of 2021. It’s a classic example of the Fear of Missing Out (FOMO), which in investing usually means missing out on a rapidly appreciating stock. It sometimes leads to impulsive decisions to buy after a significant price run-up.

That doesn’t mean every decision to buy a stock after major gains is driven by FOMO. A company’s stock price surging because of a gangbusters quarter and an announcement of promising innovations would be different (and likely more sustainable) than a sudden surge due to a short squeeze. The former is generally driven by rational analysis, while the latter by the promise of immediate gains or the pain of regret.

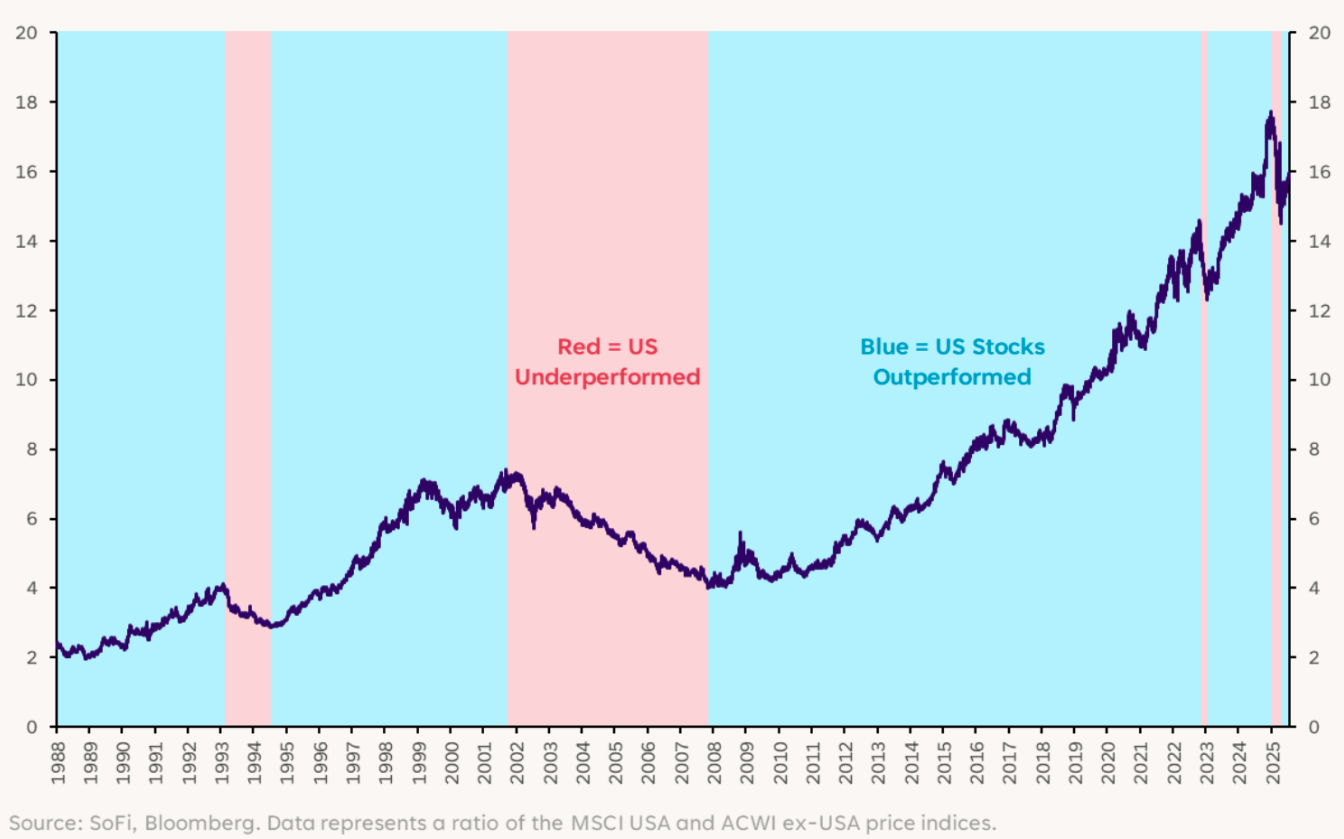

Some telltale signs of these dynamics have been on display over the last week or so, with a new batch of meme stocks emerging. For example, Kohl’s (KSS), Opendoor Technologies (OPEN), Krispy Kreme (DNUT), GoPro (GPRO), and Beyond Meat (BYND) have seen major volatility this week, with the stocks experiencing 20-30 percent intraday price swings and trading volumes surging to over 22 times the norm.

Daily Trading Volumes Relative to H1 2025

Always Lurking

Perhaps the most common behavioral tendency investors deal with is loss aversion. This deep-seated psychological bias is particularly salient during periods of high volatility and uncertainty.

Loss aversion is a cornerstone concept of behavioral finance. It refers to the tendency people have to feel the pain of a loss more intensely than the pleasure derived from an equivalent gain (e.g. if your net worth is a million dollars, losing a million dollars would likely be far worse than winning a million dollars). This asymmetry means that investors are often more motivated by the desire to avoid a loss than they are by the prospect of making a gain.

There are many different facets to loss aversion, but the current environment of scary headlines, reemerging inflation fears, and market volatility can trigger its destructive aspects. One such example is panic selling, when investors get scared and indiscriminately sell their holdings during a drawdown or emergence of negative news. The sell-off following the April 2025 tariff announcements serves as a recent example of this. The S&P 500 fell sharply as investors reacted to the new uncertainty, with many selling first and asking questions later.

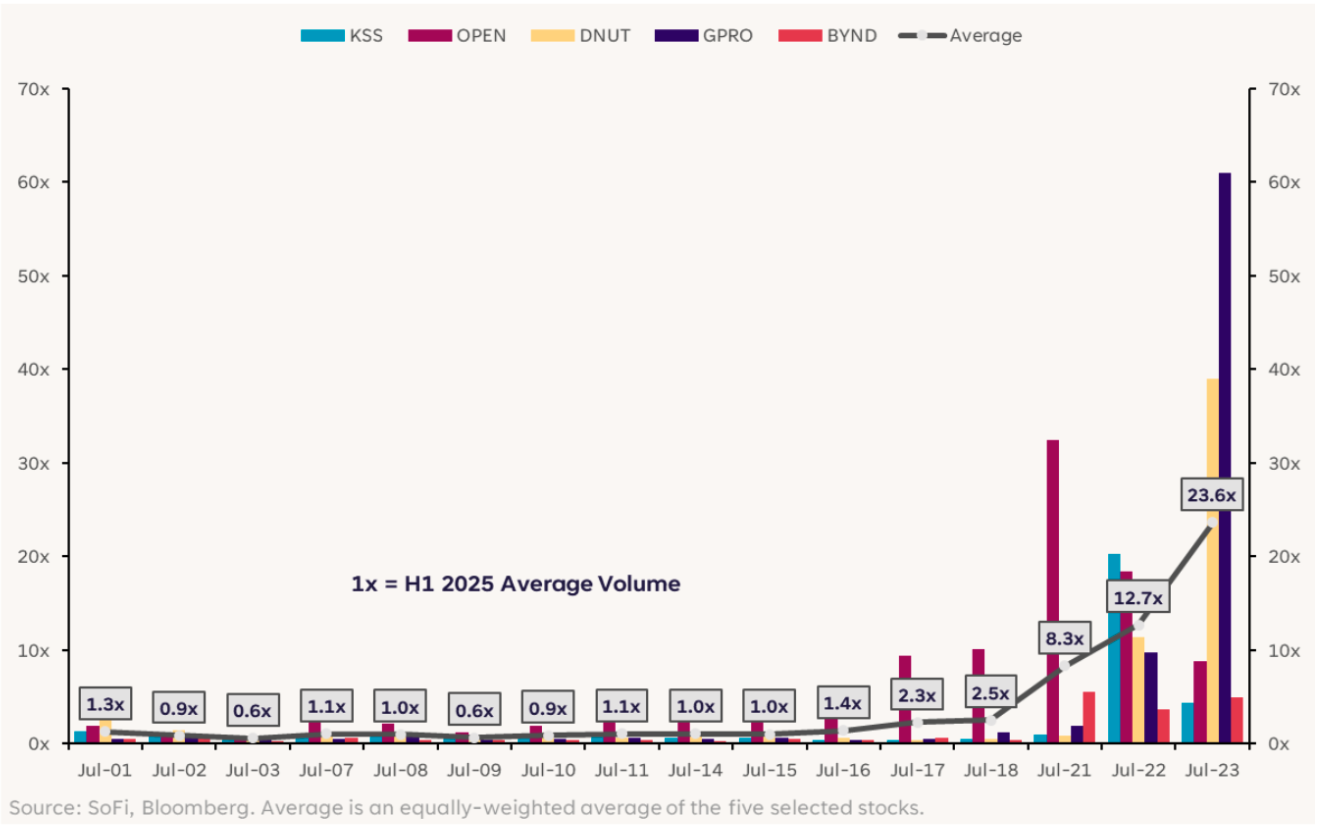

With the S&P 500 now near a record high, one would think that investor bullishness would be back to where it was early in the year. We can proxy for this by looking at dealer positioning in S&P 500 futures, which is updated weekly. Basically, because dealers generally position themselves on the opposite side of investors (in order to maintain overall neutral exposure), we can get an idea of how investors feel. The latest data shows that dealer positioning has gotten less negative since March and is the least negative since early 2024, which means that investors have gotten more negative.

Dealer Positioning in S&P 500 Futures

While panic selling is one way loss aversion can manifest, another is through a phenomenon called the disposition effect. As we discussed last year, this is the tendency for investors to sell their winning investments too early while holding on to their losing investments for too long. The reluctance to sell a losing asset is a direct consequence of loss aversion; selling would mean “realizing” a loss, which is psychologically painful and forces the investor to admit they made a mistake.

In today’s market, with its stark divergence between a few high-flying stocks and many laggards, the temptation to lock in gains on winners prematurely or hold on to losers in the hope they will “get back to even” is particularly strong. This behavior can trap capital in underperforming assets and prevent investors from letting their successful investments compound over the long term.

Think, Then React

The market will always present new narratives, new uncertainties, and new temptations. Succeeding as an investor over the long term isn’t about being able to predict the future, though that would definitely help. We can’t fully rid ourselves of the emotions that seep into the investment process — we’re human after all — but by understanding our biases and having a plan, we can manage them more effectively.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.