Week Ahead on Wall Street: A Shutdown Tipping Point?

Estimated reading time: 0 minutes

The government shutdown, now the longest in U.S. history, has dragged on for over 40 days. And now, having already missed one paycheck, hundreds of thousands of federal workers are set to miss another one. Beyond the direct and painful hit to families, the blow to consumer incomes risks derailing consumer spending, which accounts for over two-thirds of U.S. gross domestic product (GDP).

Since air traffic controllers and TSA staff have to work without pay, staffing shortages are also intensifying. To cope with the pressure, the Transportation Department and Federal Aviation Administration ordered flight cuts of approximately 10%. This all comes ahead of the Thanksgiving holiday week, one of the busiest and economically important parts of the year.

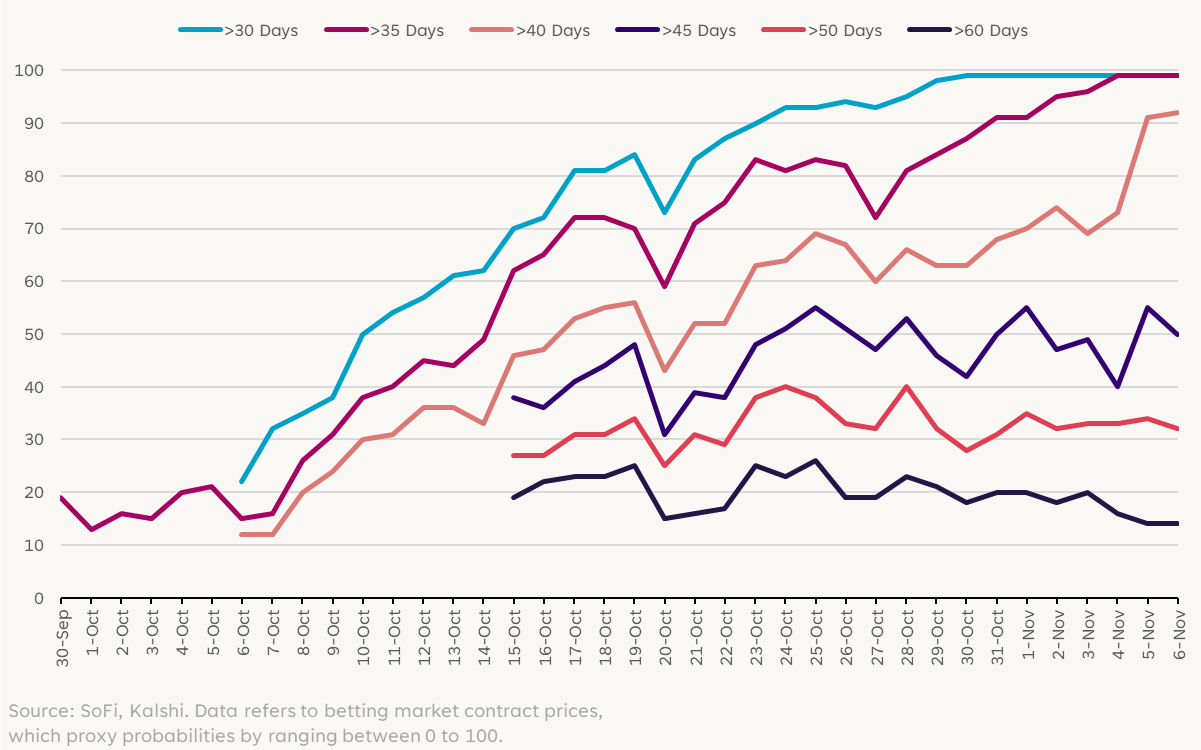

The threat to the economy adds pressure on lawmakers to find a solution. And although betting markets suggest traders expect the shutdown to drag into next week, things can change very quickly.

Who knows if we’ll see the first real signs of progress toward a deal this week, but until the government reopens, expect more market choppiness.

How Many Days Will the Government Be Shut Down This Year?

Economic and Earnings Calendar

Note: This list includes all regularly scheduled reports, but most that involve government data will not be released while the shutdown is ongoing.

Monday

- Earnings: Interpublic Group of Companies (IPG), Occidental Petroleum (OXY), Paramount Skydance (PSKY), Tyson Foods (TSN)

Tuesday

- October NFIB Small Business Optimism: This measures how small business owners feel about current and future economic conditions.

Wednesday

- Weekly Mortgage Applications: Mortgage activity gives insight on demand conditions in the housing market.

- Fedspeak: New York Fed President John Williams will deliver a keynote speech at the 2025 U.S. Treasury Market Conference. Philadelphia Fed President Anna Paulson will speak at the regional Fed’s annual fintech conference. Atlanta Fed President Raphael Bostic will discuss economic trends at the Atlanta Economics Club.

- Earnings: Cisco (CSCO), TransDigm Group (TDG)

Thursday

- October Consumer Price Index: The CPI is one of the most popular indicators for tracking consumer price trends and is a marquee release for market watchers.

- October Treasury Statement: This summarizes the U.S. federal government budget by tracking government revenues and expenditures.

- Weekly Jobless Claims: This high frequency labor market data gives insight into filings for unemployment benefits.

- Fedspeak: St. Louis Fed President Alberto Musalem will take part in a fireside chat on the economy and monetary policy.

- Earnings: Applied Materials (AMAT), Disney (DIS)

Friday

- October Retail Sales: This measures spending at retail stores and is a key indicator of consumer demand.

- October Producer Price Index: The PPI tracks price trends that producers face and is down significantly from its peak earlier in the cycle.

- Fedspeak: Bostic will take part in a moderated discussion at the Association for Public Policy Analysis and Management’s annual conference. Kansas City Fed President Jeff Schmid will discuss monetary policy and the economic outlook at an energy conference hosted by the regional bank and the Dallas Fed.

- Earnings: Qnity Electronics (Q)

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.