Looking At: Why to Diversify

Estimated reading time: 7 minutes

31 Flavors

In the heat of August, let’s think about ice cream — in particular, a place that offers 31 flavors. If you’re a two-scoop kind of customer, you might choose two different flavors for the same cone, knowing that the combination will be better than each by itself. Some flavors are classics that almost everyone likes, some are more unique — a more acquired taste, if you will. Some you may have liked as a kid, and others are more adult-friendly.

We could carry this analogy on and on. Investment portfolios can be thought of as a combination of different flavored assets, and now is one of the most important times to be thinking about how to mix them together to create a durable portfolio.

Last week we wrote about fresh highs on the major indices, and this week markets hit another set of fresh highs. The S&P 500 has now hit records 17 times this year, many of which have occurred in just the past couple months.

S&P 500 On a Roll

For investors broadly, that’s great news. Portfolios are rising and people are feeling much better than they were in April. As we know, the performance of the S&P 500 and Nasdaq is being driven by a small group of mega-cap stocks. As a result, we also know that many investors have a large amount of exposure to that group — some intentional, some as a function of how much it has risen over recent periods.

The Setup Right Now

Anytime there is concentration in a portfolio, diversification should be top of mind. But with markets at new highs seemingly every few days, that’s even more the case. High valuations present the risk of volatility when sentiment shifts even a little bit.

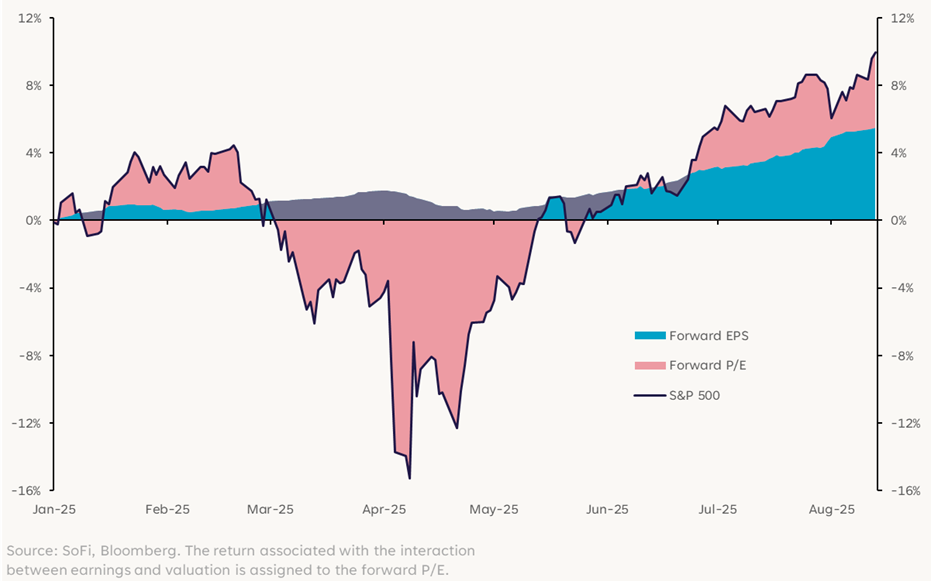

We’ve used the chart below many times because it’s one that seems to stay relevant no matter what the market trend looks like. It shows how much of the market’s return can be attributed to earnings growth (blue), and how much can be attributed to growth in valuations (pink). We call the growth in valuations multiple expansion, and it largely depends on how strong sentiment and momentum are over a period of time.

S&P 500 Year-to-Date Performance

The main takeaway is that the pink portion is much more sensitive to volatility and can experience big swings quickly. Let us be clear, We are not saying a big swing is coming, but when the pink portion is positive and growing, it’s important to take note and keep protection in mind.

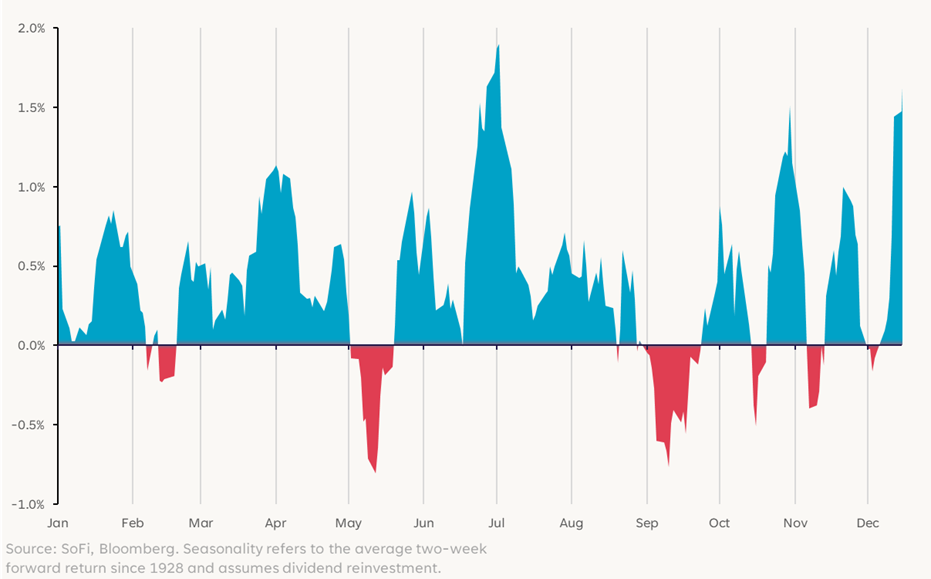

Seasonality is another reason to consider diversification right now. We don’t find seasonality a strong argument to buy or sell assets, but I do admit it’s a force that tends to repeat more often than not, and late August through September have historically been volatile periods for markets.

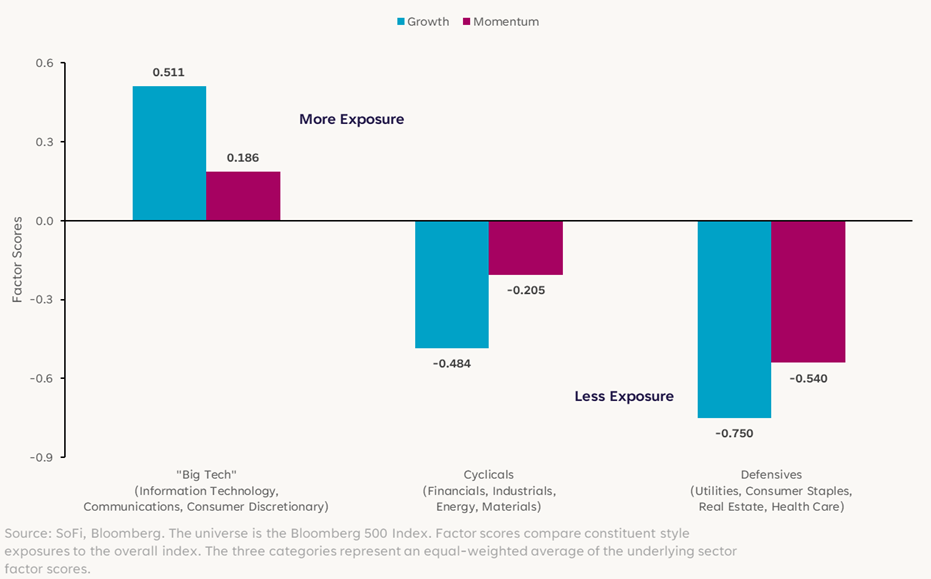

Large-Cap Factor Scores

In short, concentration risk — when markets are led by a small group of names, sentiment risk — when returns are driven by multiple expansion, and the fact that we’re entering a typically weak time of the year, all suggest to us that now is as good a time as any to make sure there are other flavors in the portfolio.

How to Diversify

When we think about diversification, it’s not just about having different types of stocks in the portfolio, it’s about having different types of drivers in the portfolio. One way we like to look at what’s driving markets is with factors, which are different attributes of securities that influence how they perform in varying market conditions.

A good way to diversify the equity exposure in portfolios is to diversify the factor exposure. We know that in recent years, markets have been increasingly driven by the momentum and growth factors. Breaking it down further, we find that the sectors most exposed to momentum and growth are ones that are influenced by what we refer to as “big tech” and include Technology, Communications, and Consumer Discretionary.

Not surprisingly, these are also the sectors considered among the most expensive in markets right now.

In order to diversify the drivers, we want to have some exposure to sectors that aren’t as sensitive to growth and momentum factors. These fall into the other buckets above: Cyclicals and Defensives.

But not all of these are created equal, so let’s whittle down the groups.

Given that markets are at all-time-highs and valuations on the S&P 500 are in the 93rd percentile, we also want to diversify the valuation risk (i.e. multiple expansion mentioned above.) This means avoiding other sectors that are trading at extreme valuations compared to their history and to the S&P 500 broadly.

Lastly, we have to take into account the current macro and geopolitical environment. Materials, for example, pose a lot of uncertainty risk right now due to tariffs and aren’t very attractive, in my opinion.

Of course, we can’t avoid all the risks, but the sectors that appear to offer diversification benefits without overly exposing investors to macro, political, or valuation risk are Health Care and Energy. Two others to consider are Financials and Real Estate. Both could benefit from falling rates for different reasons than Big Tech companies.

At the end of the day, our duty as investors is to give ourselves the opportunity for upside while keeping an eye on the major risks to our portfolios. In the current environment, although we remain optimistic and believe in this bull market, we also believe it’s very important to spread out your exposure and try some other flavors.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.