Looking at: Volatility Vibes

Estimated reading time: 6 minutes

Speed Bumps

Markets have been bumpy in recent days, which inevitably increases the chatter about risks of a deeper pullback. Investors are left to decide whether they believe this is a short-term shakeout in a bull market or something more ominous.

The warning signs of late: S&P 500 -2.3% in the past week, gold -10% since mid-October, Bitcoin -11% since late October, 10-year Treasury yield +15 basis points since the October Fed meeting, and select Asian stock markets down sharply over recent days.

Additionally, there have been headlines about funding stress in overnight lending markets, and multiple warnings from Wall Street CEOs about stock valuations being too high.

These are all valid reasons to raise your antennae and look more closely at market activity, which is what we’ll do here. The question being: Is this a speed bump or a roadblock that turns us around?

Define Bumpy?

Even with the pullbacks in several spots, the volatility index (VIX) has remained contained, only getting over 20 for about 30 minutes on Nov. 4, but bouncing around in the high teens otherwise. For reference, the VIX spiked to 29 on Oct. 17 when markets got nervous about new headlines surrounding regional banks, and it rose to 60 in April after Liberation Day tariff announcements. All things considered, a level of 20 isn’t very high.

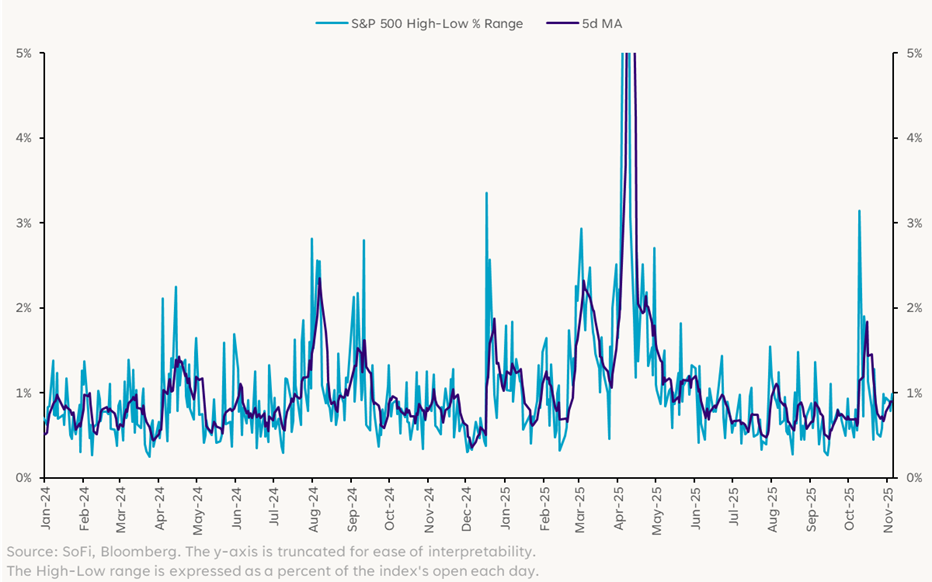

Another way to analyze volatility is by looking at the intraday ranges on the S&P 500. During volatile periods, the difference between the day’s high and low tends to become much wider as markets oscillate between extremes. Recent measures show that it’s been subdued and not setting off alarm bells.

Intraday Ranges

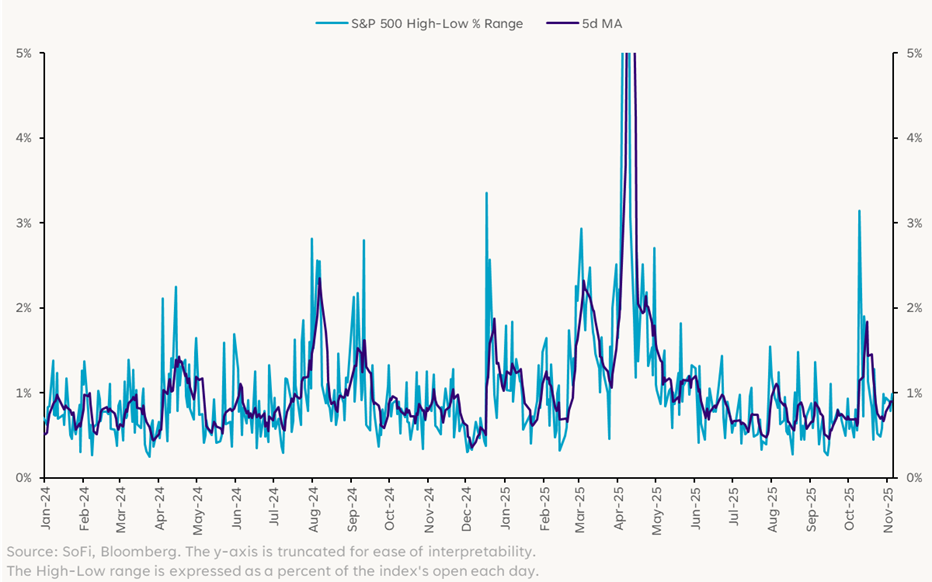

In the bond market, the rise in Treasury yields has given investors pause, especially on the heels of two rate cuts by the Federal Reserve. There are a number of reasons this could be happening, not least of which is concerns around inflation reigniting. But one of the most important things to watch is how volatile yields have been.

As we can see below, Treasury volatility as measured by the MOVE index has actually come down steadily throughout the year and remains at relatively low levels. Again, no alarm bells ringing here.

MOVE Index

Other Roads

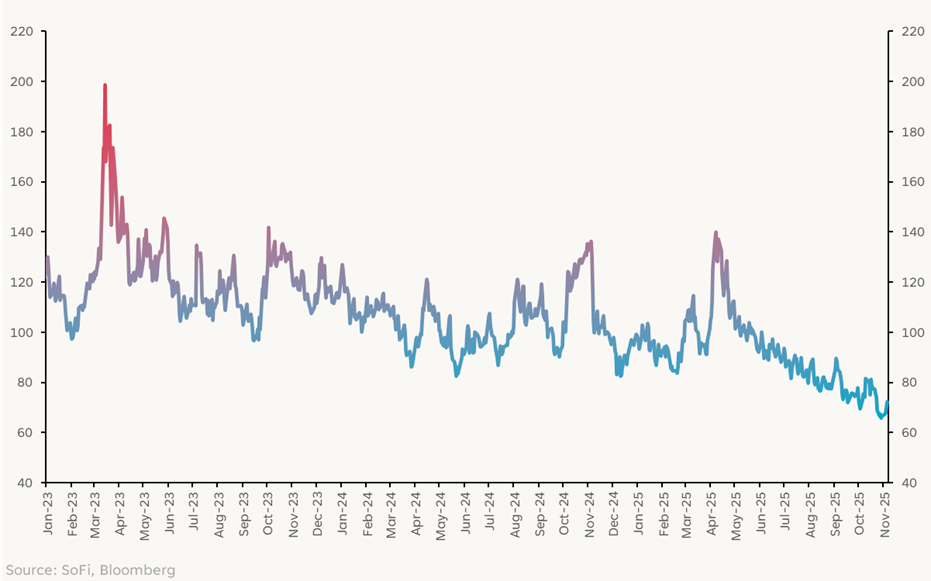

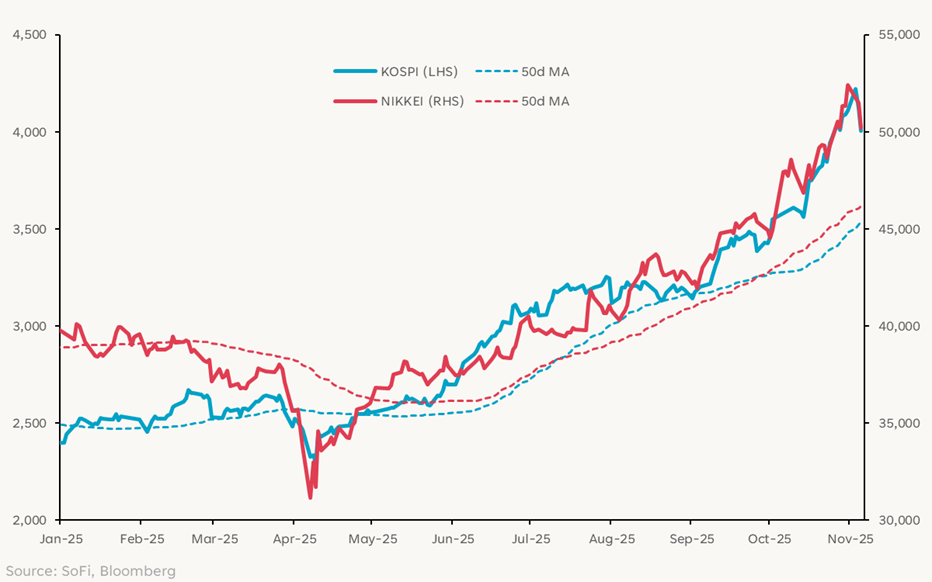

Asian markets have hit investors’ radar as well, with the South Korean and Japanese stock markets seeing steep declines over the last few days. Although peak-to-trough drops of over 8% in the KOSPI and nearly 7% in the Nikkei are unsettling, they both occurred after very strong rallies.

Before the declines, the KOSPI was up 81% year-to-date, and the Nikkei was up 34%. In that context, pullbacks of the sort we’ve seen are relatively mild and could even be considered healthy. Both indices remain above their 50-day moving averages, which is where the first typical “test” is in a drawdown.

Asian Stock Indices

Time will tell if there is something more painful to come in Asian markets, particularly as it relates to trade developments. For now this retreat from highs is not too concerning.

Spread Signposts

Lastly, credit spreads are always a good gut check of risk appetite and signs of stress in markets. The spread measures the difference between corporate bond yields and 10-year Treasury yields. When spreads are tight, investors are demonstrating strong risk appetite; As spreads widen, it means risk appetite is waning. In periods of high volatility, we’d expect credit spreads to widen.

As of now, spreads have widened a little bit (i.e. risk appetite is faltering slightly), but are nowhere near previous spikes or levels. So there are no clear reasons to run from risk.

Option-adjusted Spreads

All in all, the bumps we’ve seen in markets over the last couple weeks can be stressful to experience, but things still appear solid from a structural perspective. Over the course of a long bull market, it’s natural to have brief breakdowns in risk appetite or minor shakeouts of valuations. Nothing moves in a straight line.

Though it’s impossible to know if or when minor signs of stress could turn into major markers of weakness, as of now we don’t see much that’s screaming “danger.” Stay prudently present in this market.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.