Looking at: The Data We Have

Estimated reading time: 5 minutes

With Or Without You

The lyrics to one of U2’s most well-known songs include a line that goes, “I can’t live, with or without you.” During this government shutdown, that’s how the market feels about government economic data — or lack thereof.

As the longest shutdown in U.S. history comes to an end, we are left waiting and watching for the resumption of data releases on the labor market, inflation, and GDP, among other things. Since Oct 1, investors have had to rely on alternative data sources to piece together a view on how the economy is doing. And most data was not even being collected during the shutdown, so there’s a strong possibility we won’t see some October datasets at all.

Before the shutdown, investors (and the Federal Reserve) were hyper-focused on the labor market. They were looking for signs of weakness to gauge how much and how fast the Fed might cut interest rates. But without data from the Bureau of Labor Statistics, everyone has had to rely on ADP and Challenger, Gray, and Christmas for a read into labor market dynamics.

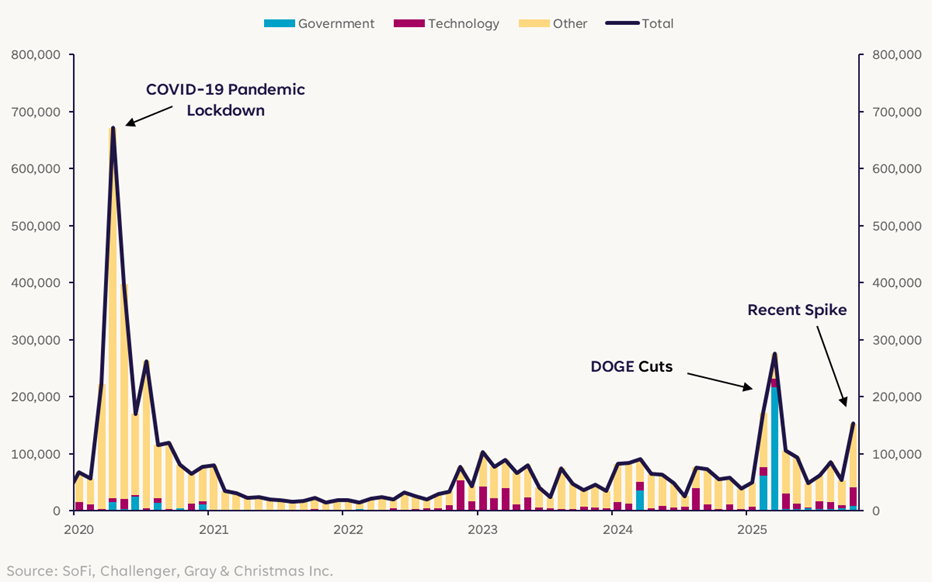

A recent dataset from Challenger raised some eyebrows because it showed a spike in layoffs which, unlike what we saw earlier in the year, was not driven by DOGE-related government cuts. This caused a minor speed bump in the S&P 500 and Nasdaq Composite indices, with both down between 1-2% the day of the announcement.

Challenger Job Cuts

Even when we’ve had government data available, there were short-term moves in data series that ended up being much ado about nothing, so we try not to overreact to a one-time change like this without digging deeper.

Twist of Fate

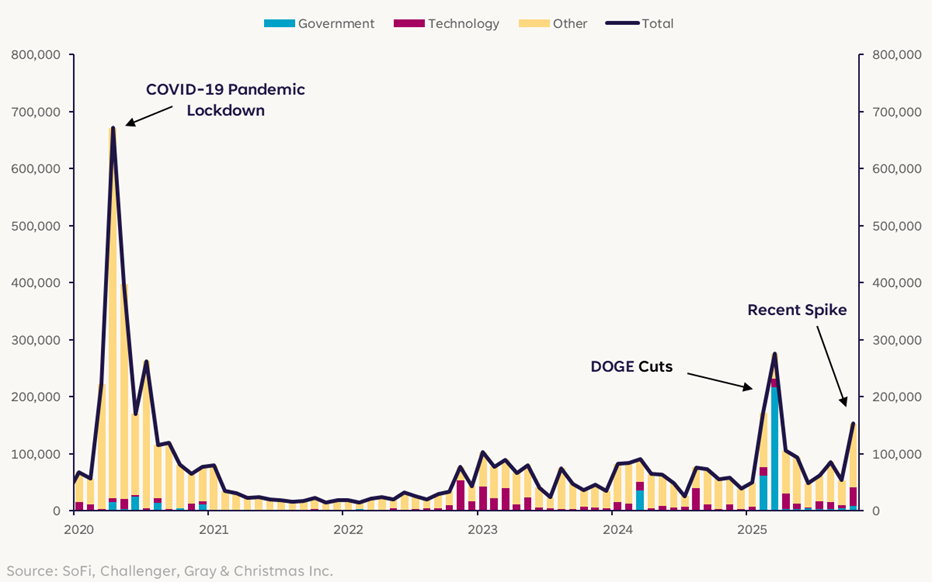

In this case, digging deeper presents a little more to worry about. Not only is it concerning that the number of job cuts was up 185% compared to September 2025, and 175% compared to October 2024, but cost-cutting became a much more common reason cited by the companies.

Reasons for Job Cuts by Percent Share

The second most common reason was AI-related cuts. This could be taken as both a positive sign that AI advancements are increasing productivity and a negative sign that the labor force is being impacted.

The main takeaways from this chart? These reasons are unlikely to be one-time “shocks” to labor data and the drivers of layoffs could be changing… and not for the better.

On a Bed of Nails She Makes Me Wait

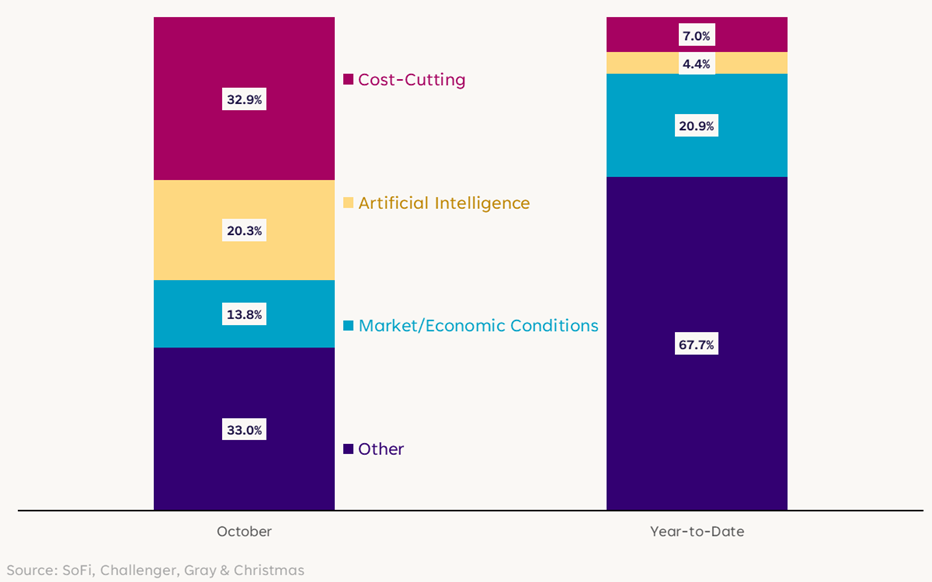

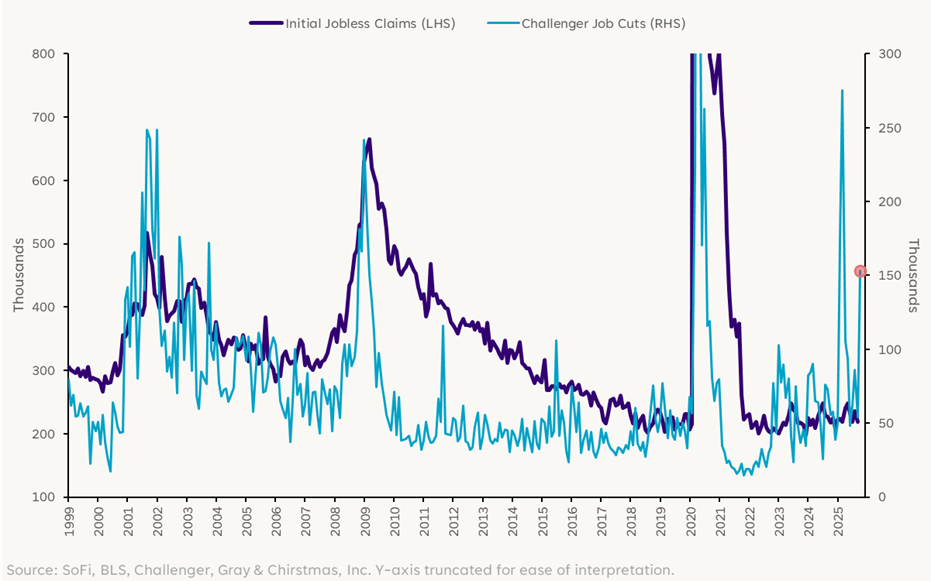

One of the most watched datasets on the labor market is initial jobless claims that (usually) comes out weekly on Thursdays. It’s one of the series that will restart when the government reopens and has long been viewed as the best real-time view of layoffs in the U.S.

This got us wondering how well the data from Challenger might foretell what we see in upcoming initial claims reports. The answer appears to be: Pretty well.

Layoff Announcements Are Correlated to Jobless Claims

The relationship between these two datasets isn’t perfectly correlated, but the trends do tend to track each other quite reliably, especially when there is a spike. This would suggest that when we do start getting initial claims data again, we might expect a notable rise.

Since both of these potential spikes are so recent, it’s impossible to know whether the “problem” will persist or prove to be a one-time anomaly, but again, the reasons for the cuts are more concerning and do not suggest a brief hiccup in the data.

Given the laser focus on the labor market, the arrival of delayed or missed data could cause market bumps while everyone tries to digest the information and set new expectations. When it comes to government economic data, it truly seems that we can’t live with or without it.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.