Looking at: Markets With Fresh Eyes

Estimated reading time: 6 minutes

Fresh Eyes, Fresh Highs

After having the opportunity to step back from the constant stream of headlines, the intraday swings in bond yields, the whipsaws of sentiment, and the ever-present fixations on Fed statements, we can confirm that an occasional change of pace is essential for us as investors — and humans.

Since we can’t take a few months off every year, we’ll have to find other ways to look through a fresh lens. we’ve always understood the virtue of seeing the bigger picture and being patient, but perhaps I didn’t fully appreciate the benefits until now.

In mid-March, tariffs were a looming idea and growth stocks were actually dragging markets down. Fast forward five months and growth stocks are once again the darlings that drive all good things, and markets are at all-time highs.

If we had gone to sleep in March and woken up today, it would appear that very little had happened except a rotation back into megacaps. But knowing that much more has transpired is exactly why lengthening our reaction time can be one of the most beneficial skills to learn as market participants.

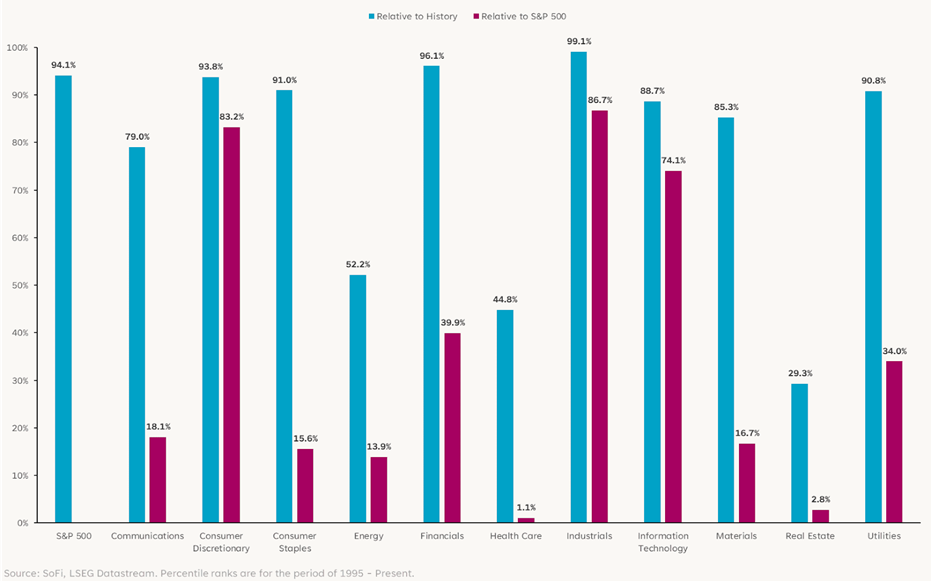

Bargains Be Gone

Two of the big things that haven’t changed are: Valuations are high, and valuations are a poor timing mechanism. Given that the S&P 500 is in the 94th percentile of its historical valuation (since 1995), it’s no wonder this is still a major story. However, it was in the 78th percentile before, dropped only to the 74th percentile in April, and has since gone even higher. Had we made investment decisions based on this metric for the past four months, we would’ve missed a lot of upside.

Forward P/E Percentile Ranks

The reality of the situation is that enthusiasm and forward-looking momentum will almost always be a stronger force than valuations. Rather than looking for reasons to talk ourselves out of the enthusiasm (guilty as charged), we need to remember that runs like this can go on for extended periods of time before the valuation police finally make an arrest.

Back in the late 90s, markets saw five consecutive years of 20% or greater returns before a multi-year downtrend. Five years straight! And in three of those five years, there was an intrayear drawdown of more than 10%… because that’s normal. How often do you think valuations were mentioned as a reason to avoid the top stocks? Probably too many to count.

Be Active, Not Reactive

Markets at these levels are difficult to impress and easy to disappoint — and investors should approach their decision-making from the same headspace. The main risks to avoid are overconcentration and chasing performance, because it doesn’t take much to give the broad indices a violent shake, as we saw last Friday after one disappointing jobs report.

The problem isn’t the shake out itself — in fact a few shakeouts from these highs would be healthy in my opinion — the problem is our knee-jerk reactions to it that leave us wishing we woulda/coulda/shoulda.

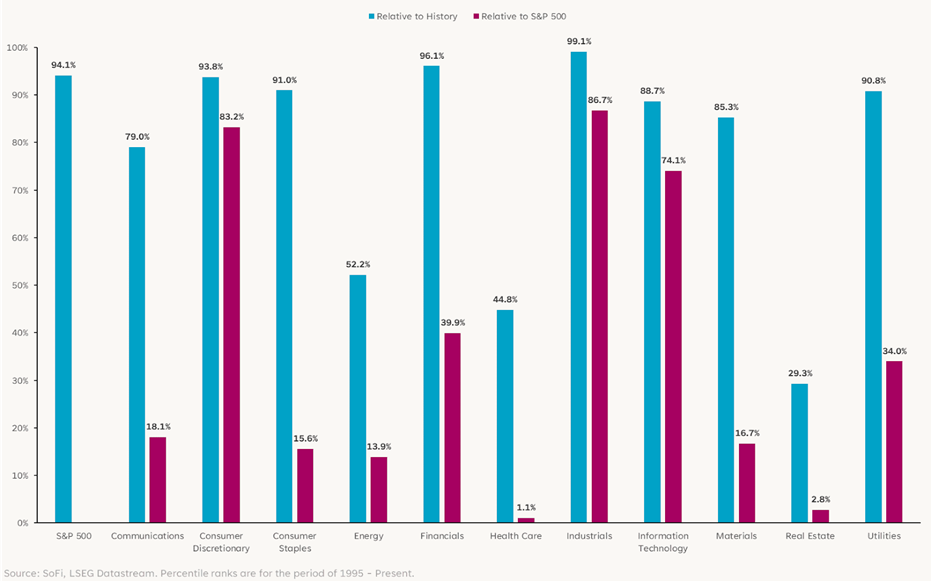

Being active as an investor doesn’t necessarily mean doing your own stock picking or only buying actively managed funds, it means being mindful of your exposure and your entry or exit points. With the 10 largest stocks in the S&P 500 now making up 42% of its overall market cap, many investors are concentrated in these names whether they intend to be or not. This makes managing your concentration risk more important right now.

Weight of Top 10 Stocks in the S&P 500

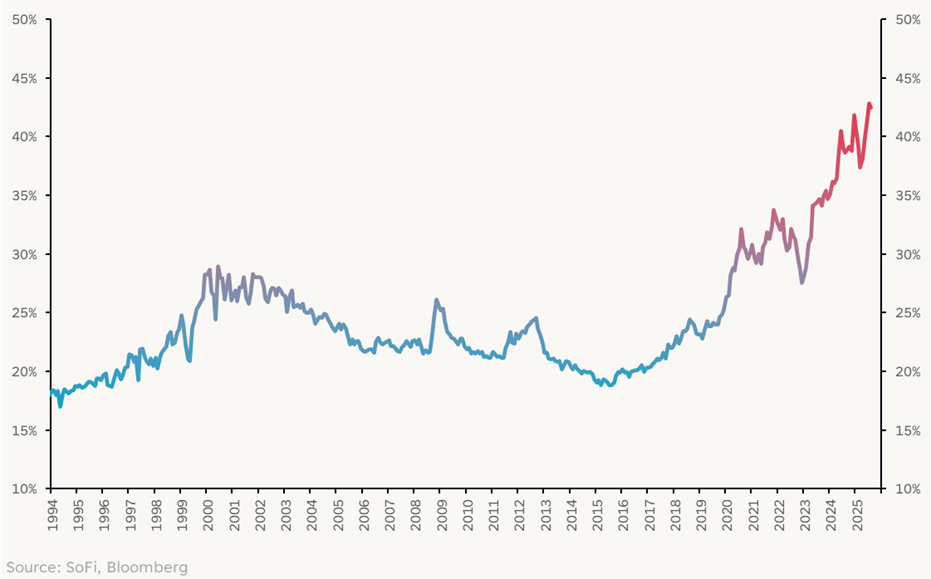

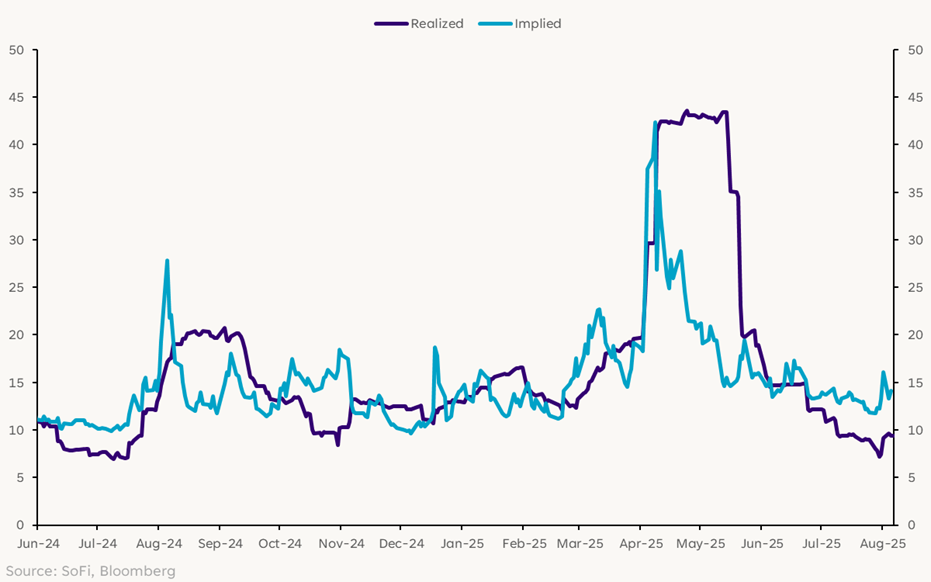

Additionally, investors are jumpy. We say that because when we look at implied volatility (what the options market expects volatility to be over the next 30 days) versus realized volatility (how big the market swings have actually been) we can see that markets expect higher volatility than what we’ve seen lately.

S&P 500 30-Day Volatility

This is a time of year when volatility tends to pick up for a variety of reasons. Last year, we saw a swift market drawdown during this exact same period. It was also after a weak jobs report and was exacerbated by trouble in Japan. No one can explain exactly why things tend to upset markets during August and September, but sometimes simply the expectation of market turmoil can cause more market turmoil.

There will always be warning signs and risks, but for now those are either too uncertain to act upon, or too early to ring the alarm bell about. We still believe markets can remain resilient even in the face of increased volatility.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.