Looking at: Good Signs in Markets

Estimated reading time: 0 minutes

Don’t Fight the Tide

Last week we were upbeat that the market environment remains resilient and positive, even with the recent geopolitical volatility. This week, we continue to see encouraging signals about cyclicality and broadening strength.

The consensus call continues to be that markets will experience a broadening out in 2026, bringing parts that have been underloved back into the spotlight. Our take has been similar, due to solid growth and earnings expectations, a Federal Reserve that appears at-the-ready to provide liquidity when necessary, and an investing environment that continues to be optimistic about AI.

But are markets demonstrating that same optimism?…To gauge the market mood, let’s look at some classic examples of positive signs.

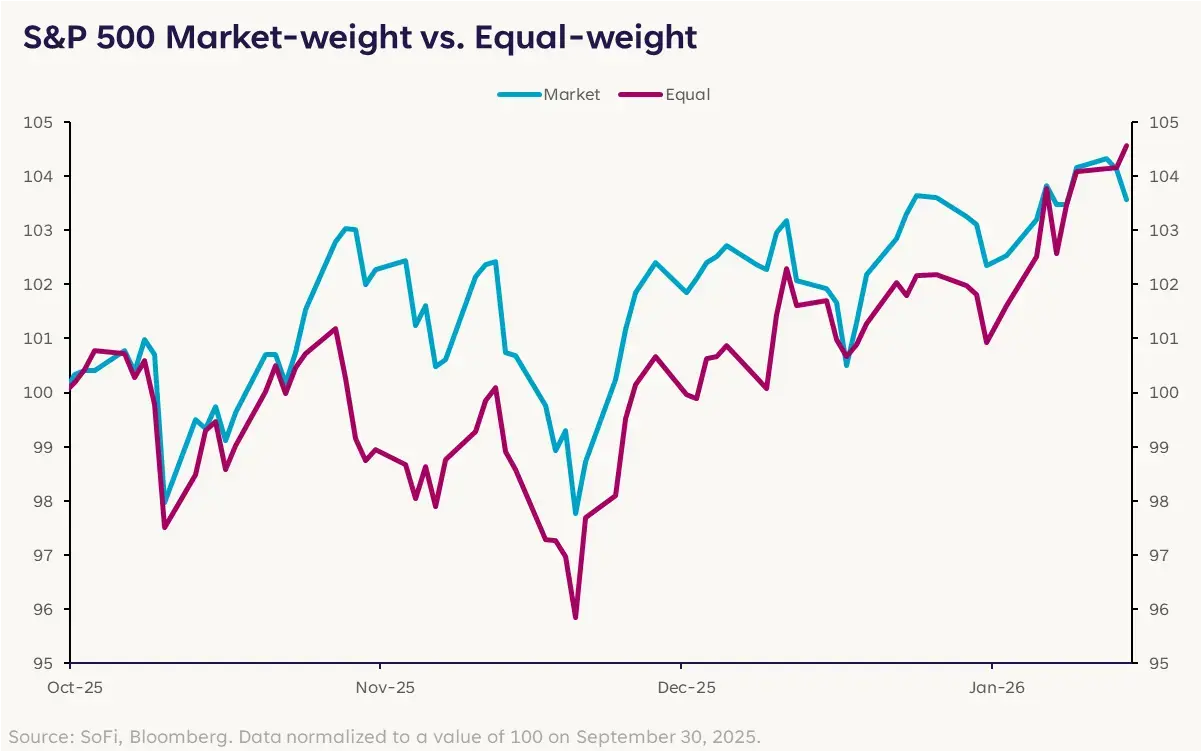

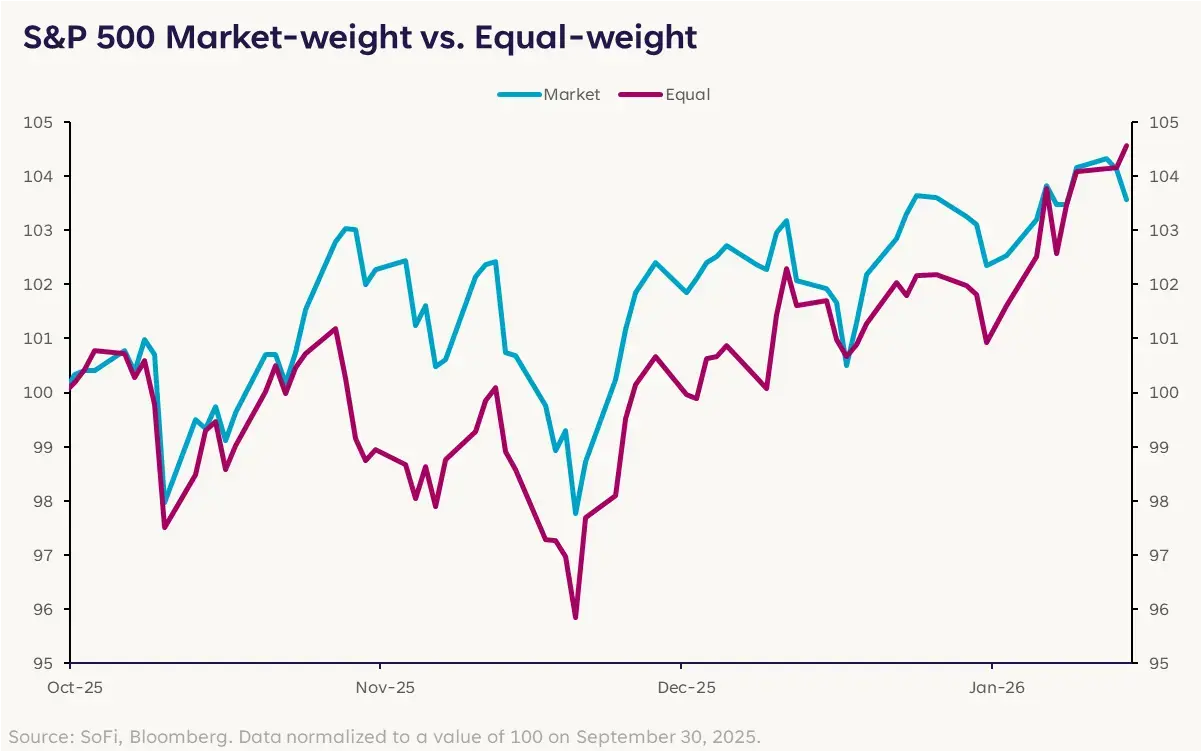

On a broad index basis, the gap between the market-cap weighted S&P 500 and the equal-weighted S&P 500 has closed considerably this month. This can be seen as confirmation that broadening strength is underway, as other stocks outside of the Mag 7 and mega-cap tech are finding upside.

Pedal to the Metal

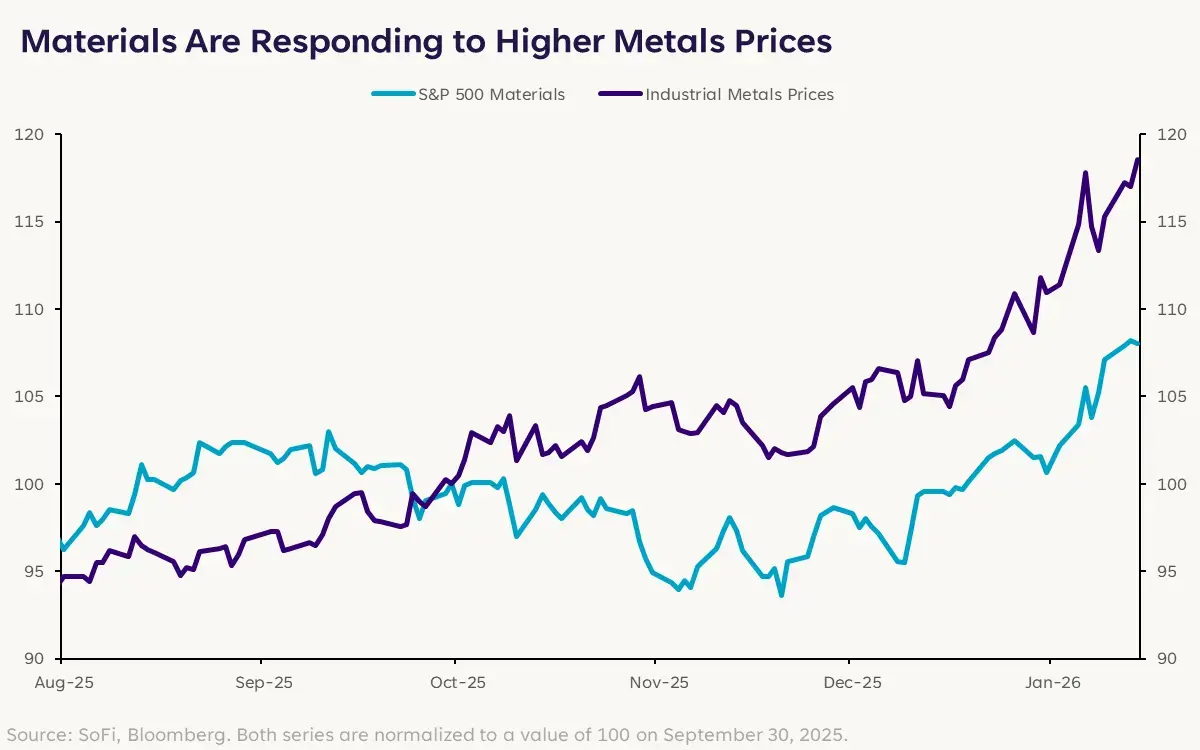

Another indicator that markets are feeling constructive? The activity in Industrial Metals commodities and Materials stocks. When economies are in a cyclical expansionary period, we would expect a reaction from these areas, which are closely related because many of the materials stocks are tied to mining.

Year-to-date, both Industrial Metals (copper, aluminum, nickel, zinc, and lead) and the Materials sector have had very strong results, with industrial metals up 6.9% and Materials up 7.3%. The S&P, on the other hand, is only up 1.2%.

Sectors like Industrials and Energy have also come out of the gates strong in 2026.

Value As the Top Dog?

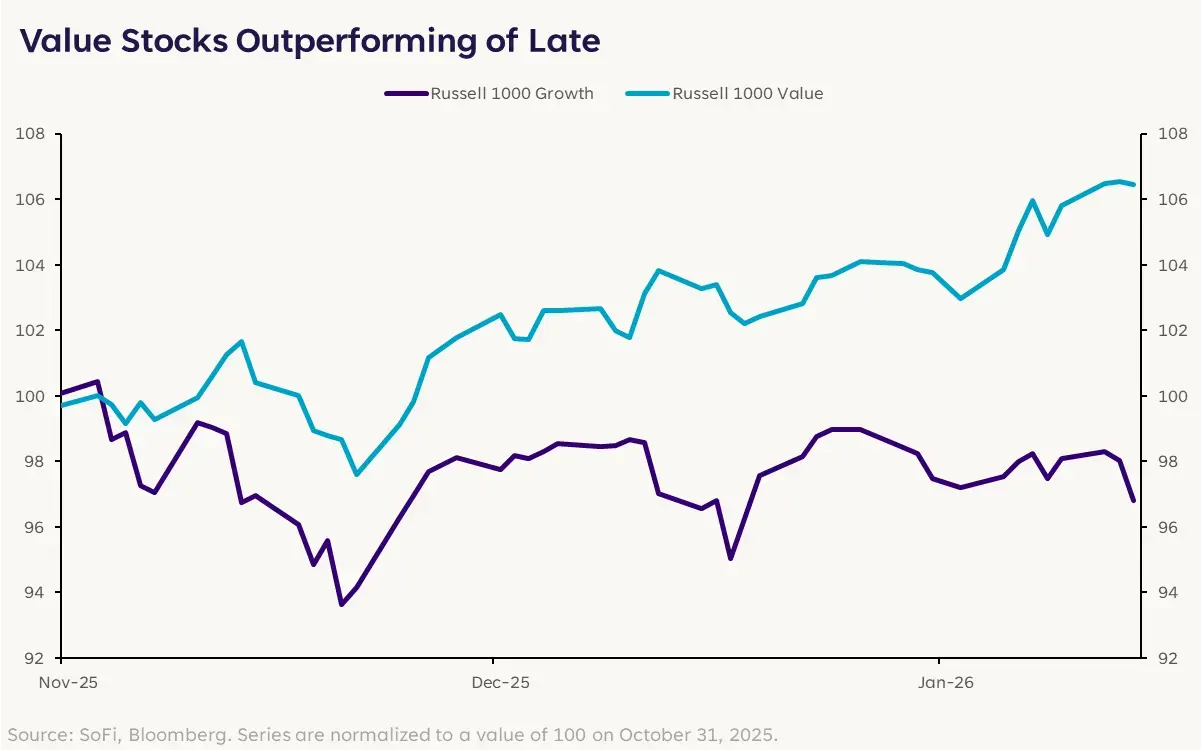

We are hesitant to point this signal out for fear of jinxing it, but value stocks are having a moment. Investors have been waiting for them to beat growth stocks for over 15 years. There have been many false starts, and this may prove to be another one, but very quietly the Russell 1000 Value index has outperformed the Russell 1000 Growth index since markets hit a rough patch in November.

This is yet another indication that other stocks in the universe are finding their way into investors’ portfolios and may continue to do so as the year progresses. This isn’t to say that growth stocks are unattractive; I still believe they are the lifeblood of this market. Consumer and investor sentiment relies on growth stocks to continue producing solid results and to keep AI optimism alive.

But perhaps finally we are in a market environment where diversifying into other sectors can be a fruitful approach. Doing so would quell some investor fears about market concentration, and serve as an encouraging sign that stocks with more attractive valuations can produce attractive results. It’s certainly a theme I’m willing to stick with this year.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.