Looking At: Buying After the Stock Market Washout

Estimated reading time: 4 minutes

Believe the Bounce?

Over the past two months markets have been on quite a ride, although you wouldn’t know it by looking at broad index returns. Since mid-December, the S&P 500 is up 1%, while software stocks and bitcoin are down 24% and 27%, respectively. That’s a big spread, and was even more dramatic before the recent bounce in some of the washed-out pockets.

As we watch markets try to find solid footing this week, the main questions are what’s driving the divergence and is it over?

Value seekers are drooling over the bear market-level correction in the software industry group and other stocks within the Information Technology sector, while others are concerned that the AI trade may have lost momentum.

There’s validity to both of these ideas, but I land closer to the value-seeking bunch.

How Low Can it Go?

It’s uncomfortable to watch when an investment goes down quickly and by a large magnitude, but that can also signal that markets have overshot and are poised for rebound. Technical indicators can help us gauge the severity of a drawdown and/or likelihood of a recovery.

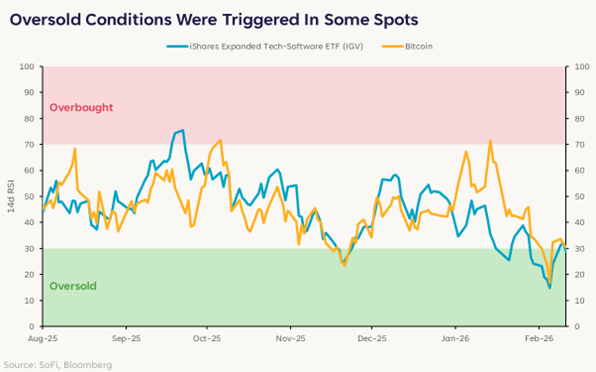

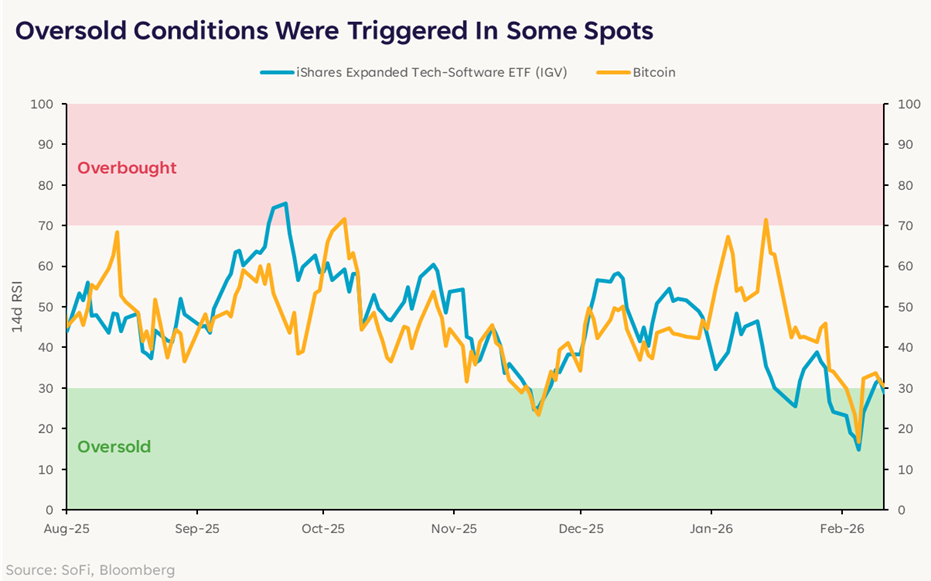

Software and bitcoin’s recent drawdowns show us that both entered oversold territory as measured by relative strength indices (RSI) around the beginning of February. For reference, an RSI <30 signals “oversold,” while an RSI >70 signals “overbought.” Not only did both of these investments drop below 30 RSI, but they did so in swift and dramatic fashion.

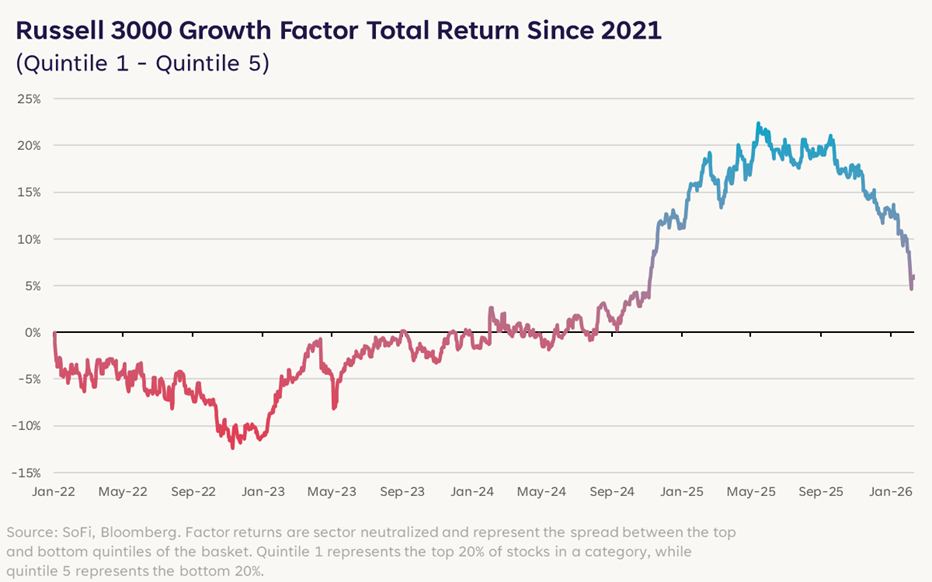

To add insult to injury, if we broaden out the lens to look at the performance of the Growth factor broadly, it’s been in a downtrend since the middle of 2025 and had a more violent drop in the few months. This paved the way for value stocks to outperform growth stocks, and pushed investors into sectors such as Energy, Materials, Consumer Staples, and Industrials.

The collapse in the Growth factor is a big part of why investors have gotten so nervous. AI-related stocks are the dominant players in that theme and have not performed well relative to other parts of the market recently. Given how dependent we are on optimism and sentiment surrounding AI, this is a disconcerting change.

Momentum Changes Are Not Thesis Busters

The majority of this volatility has been driven by sentiment, not fundamentals. These businesses did not broadly report a contraction in revenue, earnings, or profits. The AI theme is still alive and well, as evidenced by several mega-cap tech companies announcing an increase in capital expenditure expectations in recent weeks.

As AI moves to new phases in its lifecycle, there are inevitably going to be new disruptions that will force companies to adapt and move faster in order to stay relevant. Not every company will benefit – there will be some that lose and die off in this race. But it is not likely to wipe out an entire industry (such as software) in one fell swoop.

Although sentiment can be powerful and momentum can shift quickly, it is also dominated by emotion. Investors who can keep a handle on their emotions during periods like this are positioned better to pounce on opportunities.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.