Looking At: AI Spending

Estimated reading time: 6 minutes

Spending Bender

Every earnings season, investors wait with bated breath to hear how much the big tech companies plan to spend on AI-related initiatives. Stock prices seem to react more to the outlook on that than the earnings data itself. Needless to say, AI spending continues to be the focus and that doesn’t appear to be changing anytime soon.

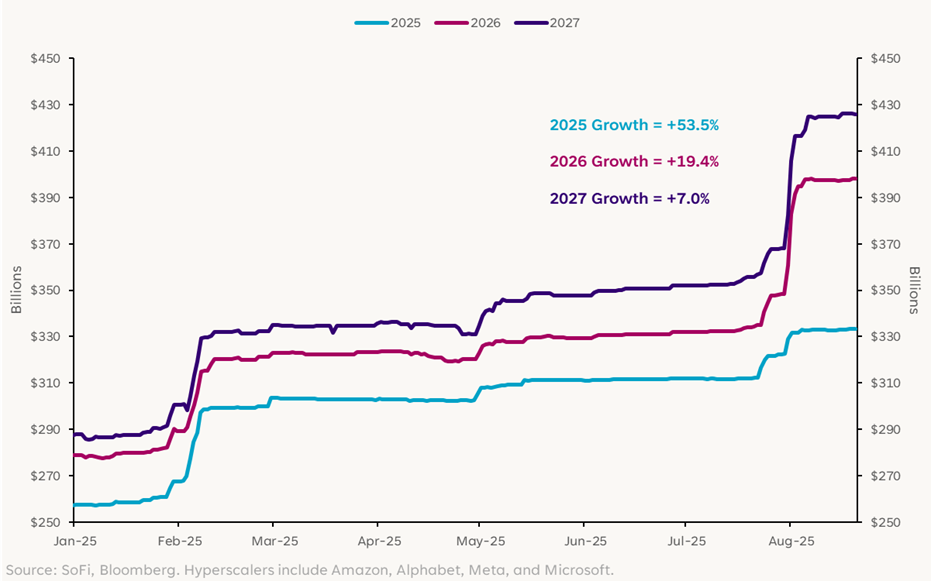

Analysts expect capital expenditures (CapEx) for the hyperscalers (Amazon, Alphabet, Meta, and Microsoft) to grow 53.5% in 2025 and 19.4% in 2026. Translating that into dollar terms, $333 billion of CapEx is expected this year from just these four companies.

Hyperscaler CapEx Consensus

In absolute terms, these are eye-popping numbers. Skeptics will tell you the companies have already overspent and it could all come crashing down. Enthusiasts will tell you the companies have to invest in order to innovate, and this is just the beginning.

Off the Rails?

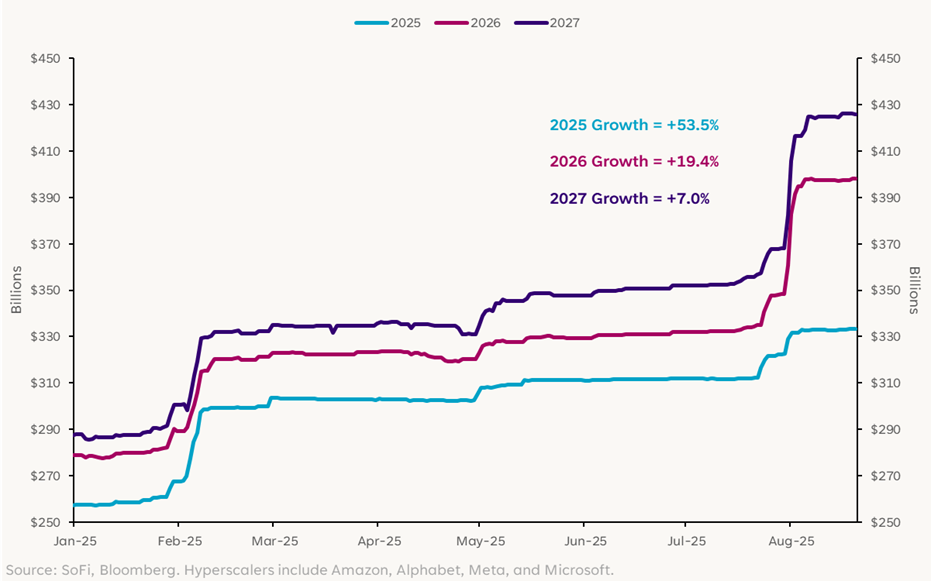

In theory, both could be right. But in order to arrive at an opinion of where we stand today, it’s worth exploring how this spending era compares to prior spending eras, namely the internet supercycle in the 90s and the railroad spending era of the industrial revolution. Both eras changed the way we lived, traveled, and conducted business, and many expect AI to do the same.

To level the dollar amounts over time, we’re looking at spending as a percentage of GDP in the applicable periods. Despite how enormous today’s absolute numbers sound, when we compare percentages, AI spending is only slightly above that of the internet era and well below that of the railroad period, which is surprising.

Infrastructure CapEx as a % of GDP, by Era

Since the railroads were so long ago and arguably a very different type of innovation, the next section excludes that era and focuses on the comparison between the internet era and today.

Blowing Bubbles

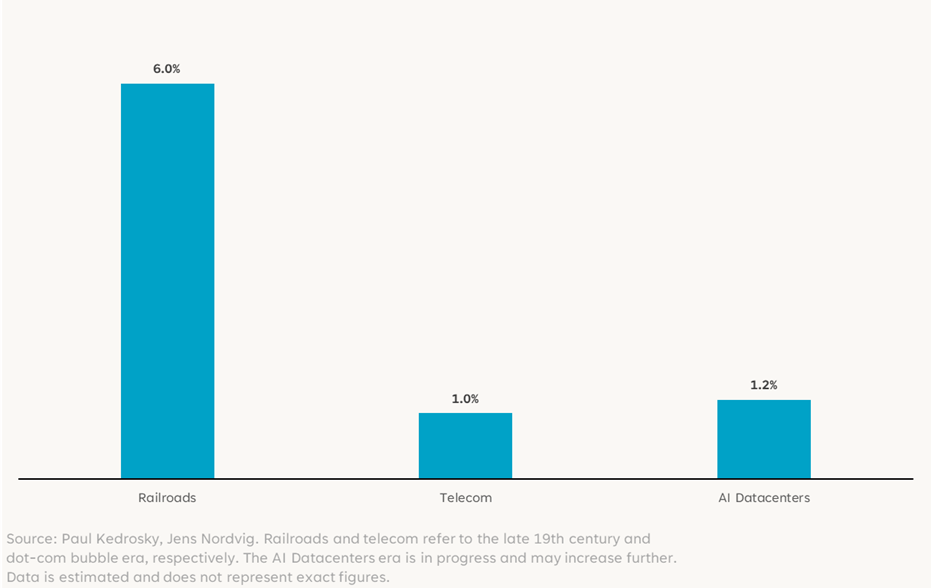

There’s been a lot of talk over the last week about the air possibly seeping out of the AI balloon as some of the big tech momentum stalls out. Many are drawing comparisons to the late 90s when the Nasdaq was near all-time highs and the Federal Reserve started cutting rates on the heels of economic jitters. Some concern over a potential repeat is predicated on the high spending rates and high valuations of a small number of names.

To put it in context, the chart below shows annual spending data as a percent of GDP for the internet era versus AI spending of today, including projections of AI spending from 2025 onward. We can see that the proportion of spending on data centers is higher than the spending on telecom was in the late 90s (though not perhaps alarmingly so until much further out.) If the hyperscalers are in fact overspending, those projections could change materially.

Dot-Com Era and Now: CapEx as a % of GDP

At present, this doesn’t seem like something that’s out of hand or off the rails. Not to mention that the companies doing this spending are stronger than many of those in the late 90s if you measure by business maturity and cash positions. It is, however, something to heed as investors — Markets tend to overshoot on both the upside and the downside. It’s possible, therefore, that markets have gotten a bit ahead of themselves and need this breather.

Resizing the Pie Slices

As we know, markets are not the economy, and in the next few weeks investors will be hyper-focused on economic data and messages from the Fed. A large driver of growth in the U.S. is consumer spending, which has been a topic of debate since pesky inflation began sending prices higher. Many feared that the consumer would eventually pull back and create a drag on GDP, but GDP has held up quite well.

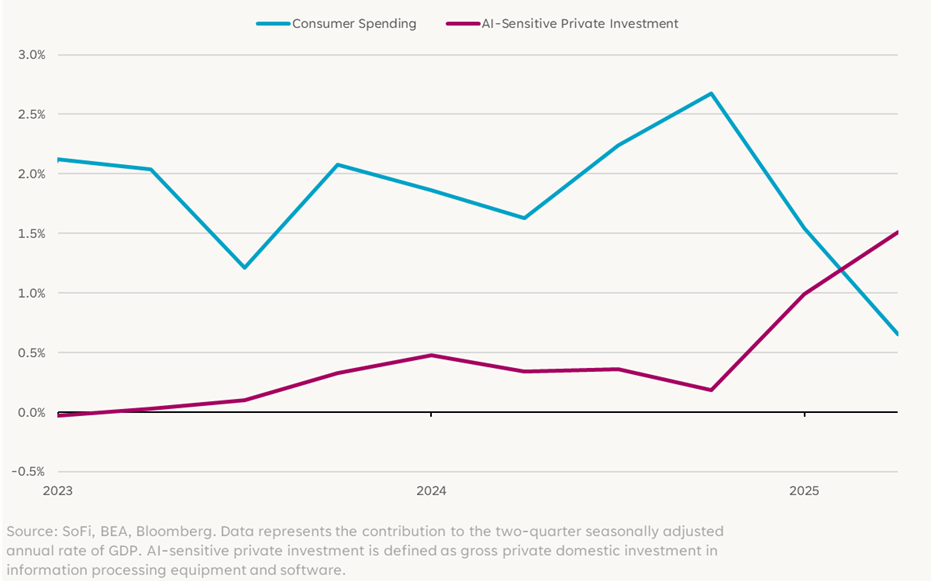

Interestingly, consumer spending has slowed, but the spending on AI has likely made up for the shortfall. Our economy has actually gotten less reliant on the consumer and more reliant on business investment over recent quarters.

2-Quarter Contribution to GDP

That begs the question: Is that good or bad? Right now, we think it’s actually been a good thing. We have always been heavily reliant on consumer spending to drive our economy forward, and we will remain that way. The possibility that other sectors of the economy could start to drive growth is a positive, in my opinion.

If this is in fact a bubble of sorts, and enthusiasm wanes, the risk is that CapEx spending could evaporate quickly. That’s the nature of things though, isn’t it? We depend on sources of growth and know that those sources could dry up if circumstances change.

The increased worry right now stems from the speed and magnitude of this spending increase, and the possibility that it went too far too fast. But even if markets have gotten ahead of themselves — and companies spend more slowly than projected — that doesn’t mean the whole era ends and the theme dies. It would just mean a reset in expectations and an adjustment to the timeline.

Those adjustments can be painful if you’re overexposed to the market reactions, but if you can keep your eye on the long-term and diversify in the near-to-medium term, the stops and starts feel less turbulent.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.