Decoding Markets: This Is All Part of the Script

Estimated reading time: 5 minutes

Passing the Baton

If you’ve checked your portfolio in the last few weeks, you’ve probably felt the jitters rippling through the market. Headline indices are still near all-time highs, but that calm surface is papering over a lot of churn underneath.

It can be unsettling, but we expected this. As highlighted in our outlook for 2026, we anticipated a broadening of the market where the baton passes from tech leaders to a wider cast of characters. And that script has in fact been playing out in real-time, with capital cycling out of some of last year’s crowded winners into new areas.

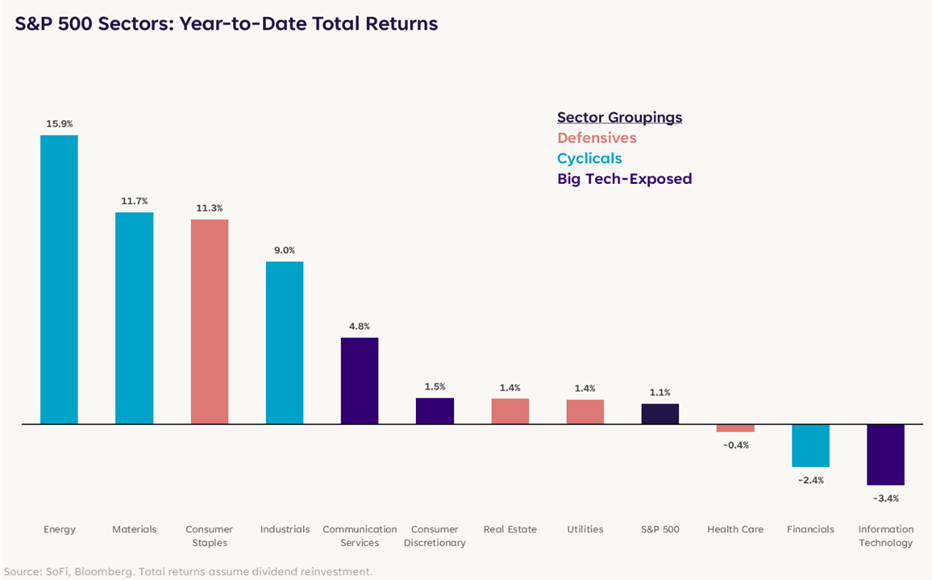

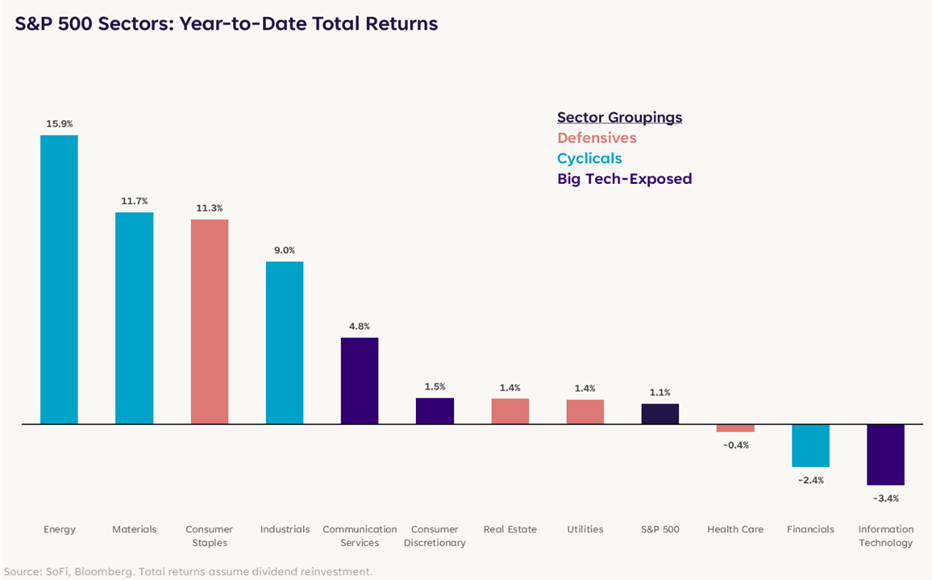

Cyclical sectors have been the primary beneficiary thus far in 2026, occupying three of the top four spots on the year-to-date leaderboard (Consumer Staples, one of our picks for 2026, occupies the other slot). Further down the board, there’s no clear sector pattern.

Software Under Siege

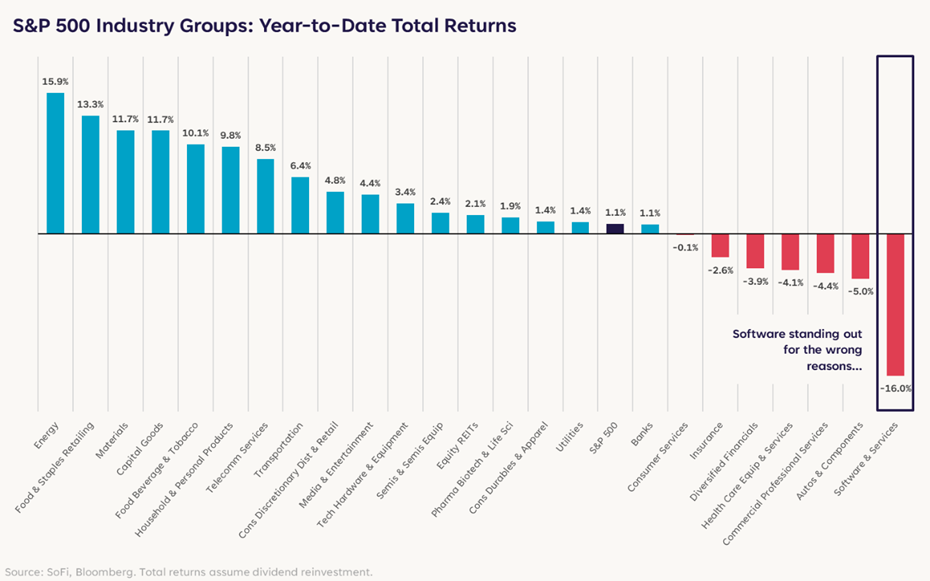

This rotation is even fracturing the technology sector itself, which brings us to the market’s most popular topic of the moment. While semis and hardware have been fine, software stocks have been pummeled, becoming the clear loser of the new year.

Down 16%, software stocks are underperforming the next worst industry group by a full 11 percentage points. The catalyst? The viral launch of Anthropic’s Claude Code and Cowork tools. Basically, the narrative that has taken hold is that these advanced agentic AI products will democratize coding and intelligence to such an extent that the competitive moats of traditional SaaS (Software as a Service) companies will be eroded. There are even some jitters that the AI agents will replace the companies themselves.

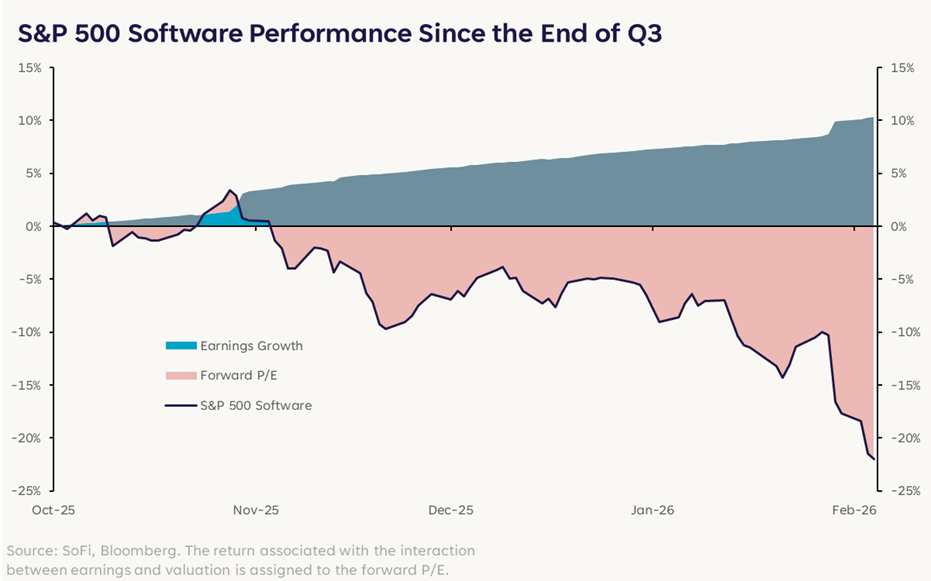

To be clear: Anything is possible, but we’re still in the early innings of what is sure to be a multi-year, and even multi-decade process. And though this could change in the weeks ahead, the current drawdown in software has been driven entirely by sentiment, not by any revisions to fundamentals.

Since the end of the third quarter, earnings growth has actually added 10.3 percentage points to total returns of software, while the forward 12-month P/E ratio has declined from 32.5x to 23.1x, which equates to a drag on returns of 32.3 percentage points! Talk about a vibe shift.

While the long-term landscape of software is undoubtedly shifting, the current sell-off might be underestimating how integral these services may end up being, as well as the ability of incumbents to integrate these very same tools into their own platforms.

Will there be winners and losers in the software space? For sure. Will the entire software space be a loser? Hard to imagine. The “sell first, ask questions later” reaction has been fueled by social media virality rather than fundamental deterioration, which increases the chances of it being overdone and exposed to a snapback.

Keep on Keeping on

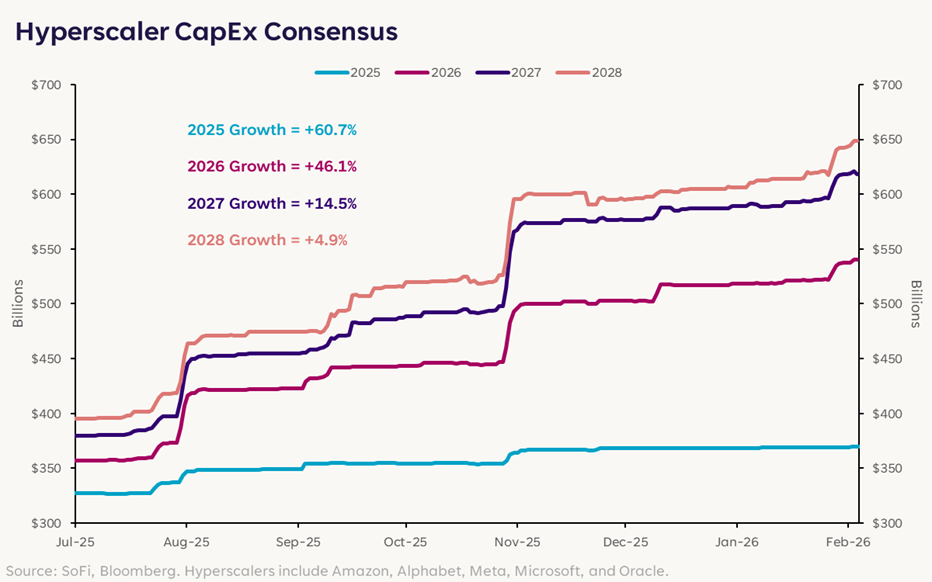

It’s important to note that the software slump doesn’t mean the AI theme is dead in the water. If it were, you’d expect the hyperscalers (i.e. Amazon, Alphabet, Meta, Microsoft, and Oracle) to start exercising more caution and tightening their belts. Au contraire, they’re actually increasing their CapEx budgets.

Consensus expectations are for these heavyweights to spend over $540 billion on CapEx in 2026, an increase of 46% from last year’s $370 billion. Those numbers are then expected to rise to $618 billion and $650 billion in 2027 and 2028, respectively. These levels of expenditure are mindblowing, but importantly translate into increased revenue for other companies.

It can be tough to remain calm when volatility hits and the baton gets passed, but panic is rarely a profitable strategy. As we said in our outlook: So long as the spending bender continues, the show will go on.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.