Decoding Markets: The Data Gets Worse

Estimated reading time: 7 minutes

Snowballing Job Weakness

You hear it in financial media a lot: The stock market is not the economy. The market doesn’t always move in tandem with economic news. It can rise even when labor data comes in weak, or fall if it looks like the economy is humming on all cylinders.

But it’s not not the economy, either.

Take the latest employment report. It sent an unsettling message about the backbone of the U.S. economy: The labor market could now be running on fumes.

The headline number last week showed just 22,000 jobs were added in August, below expectations for an increase of 75,000, and significantly fewer than in any month in late 2024 and early 2025. The three-month average for job creation is now down to 29,000, also a fraction of what it was earlier in the year.

To add to the worries, the Bureau of Labor Statistics (BLS) revised the June figure from a modest gain of 14,000 jobs into a net loss of 13,000. That’s the first month of net job losses since December 2020 and formally ends what was the second-longest period of employment expansion on record. When combined with other recent revisions, the total number of jobs created between May and July is 274,000 lower than first reported.

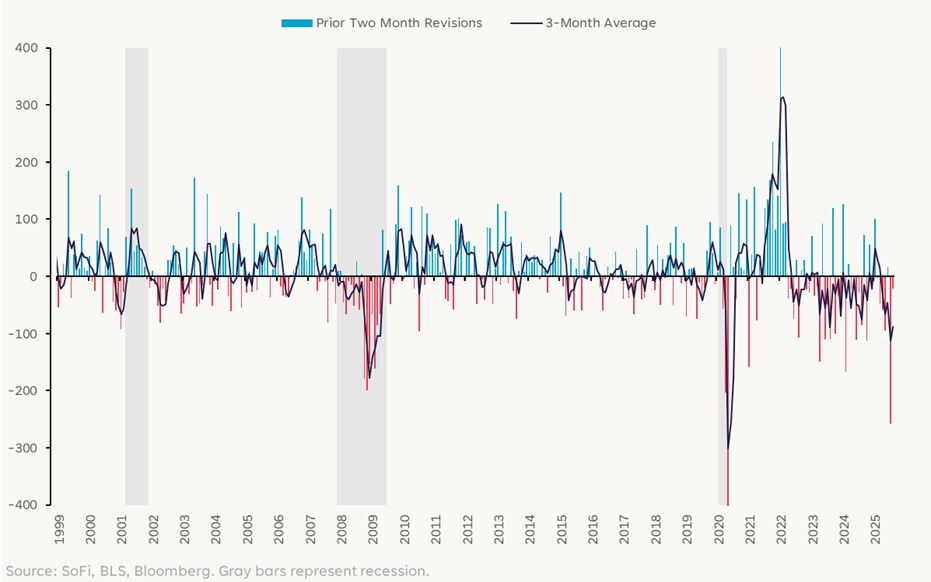

Big downward revisions like these often emerge at economic turning points, raising concerns that this could be the start of the dreaded “r” word – recession.

Job Revisions Often Turn Negative In Downturns

Breakeven What?

Par for the course, however, there’s a nuanced debate unfolding about how to interpret this big deceleration in job growth.

The debate among economists and Federal Reserve officials centers primarily on the concept of the “breakeven” employment rate. This is basically the number of jobs the economy needs to create each month to keep the unemployment rate stable, and it accounts for the natural growth of the working-age population and the rate at which people enter the labor force.

Think of it as the minimum lift needed to prevent a plane from falling as it’s flying. If job growth surpasses this breakeven number, the unemployment rate tends to fall. If it falls short, the unemployment rate is likely to rise.

Back in April, the economists from the Federal Reserve Bank of St. Louis estimated the breakeven rate was over 150,000 jobs per month, but an analysis from late August suggests that the breakeven job creation level has fallen dramatically, and is now somewhere in the ballpark of 32,000-82,000 jobs per month.

The primary driver of this recalibration is a sharp contraction in the supply of labor due to a significant reduction in immigration. Because of more restrictions on immigration, fewer workers are entering the labor force, which means the economy needs fewer jobs added each month to keep the unemployment rate steady.

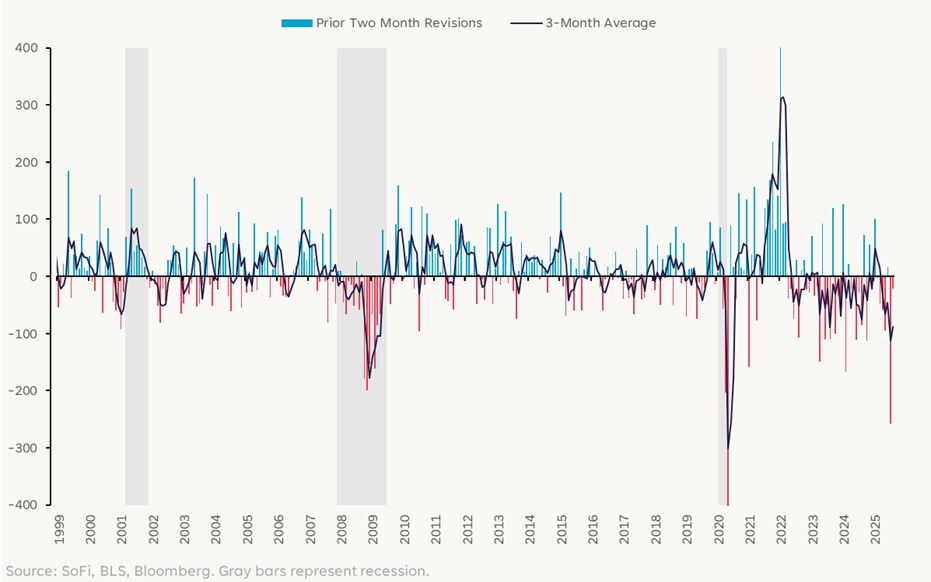

Real-world data supports this idea. Even though the economy has added relatively few jobs in recent months, the unemployment rate has only risen from 4.1% to 4.3%. When unemployment was at these levels in the prior business cycle, 150,000-200,000 jobs were being added each month. Moreover, you’d have to go back to 2010 to find three-month job growth this low (excluding the pandemic). The unemployment rate was over 9% then.

Slowest Job Growth Since 2010 Excluding Pandemic

In other words, if the breakeven rate hadn’t fallen, we would probably be seeing a sharper rise in unemployment.

Now, that doesn’t necessarily mean we shouldn’t be worried about the jobs data. Low is low, even if Fed Chair Jerome Powell describes labor demand and supply as in a “curious kind of balance.” And the risks are rising. But it does suggest less of a rush for the Fed to cut its benchmark interest rate in order to support the labor market. After all, Fed officials can make it more attractive for businesses to borrow money and grow, but they can’t increase the number of people looking to work.

Consequences of Politicization

Speaking of the Fed, there’s an additional risk that has been brewing for much of this year but looks to be finally boiling over. It’s not about inflation. It’s not about jobs. In many ways, it’s beyond the complexities of economic data altogether. It’s about the politicization of institutions typically seen as nonpartisan and “above the fray.”

In mid-August, President Trump announced he was firing Fed Governor Lisa Cook in response to mortgage fraud allegations from 2021, which itself occurred shortly after he fired the BLS Commissioner in the aftermath of a weak July jobs report. While the Federal Reserve Act says a governor can only be removed for cause, he said the allegations met that standard.

Governor Cook challenged this in court, and on September 9 was granted a favorable ruling that will allow her to remain in her post while the case proceeds. While much of the proceedings are beyond the scope of this column (or really of market analysis in general), the legal battle isn’t an isolated event but the culmination of a sustained campaign of public pressure on the Fed to lower interest rates.

The political storm surrounding the Fed is far from over. This case seems destined to eventually find its way to the Supreme Court, and in either situation the longer-term risks for investors are elevated. For decades, markets have operated under the assumption that the Fed would act independently to ensure price stability. If that assumption goes away, inflation expectations could get increasingly unanchored, with investors and businesses expecting higher inflation over the long run.

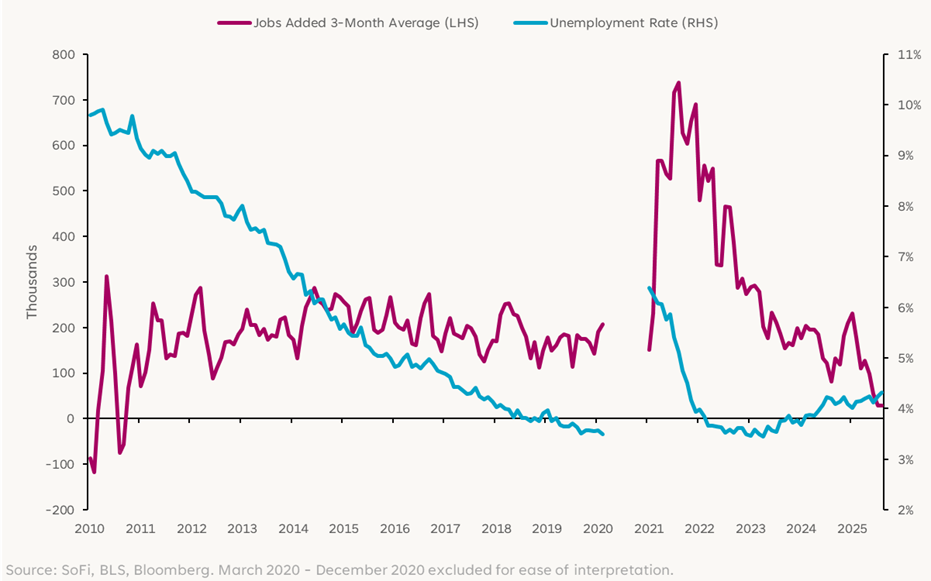

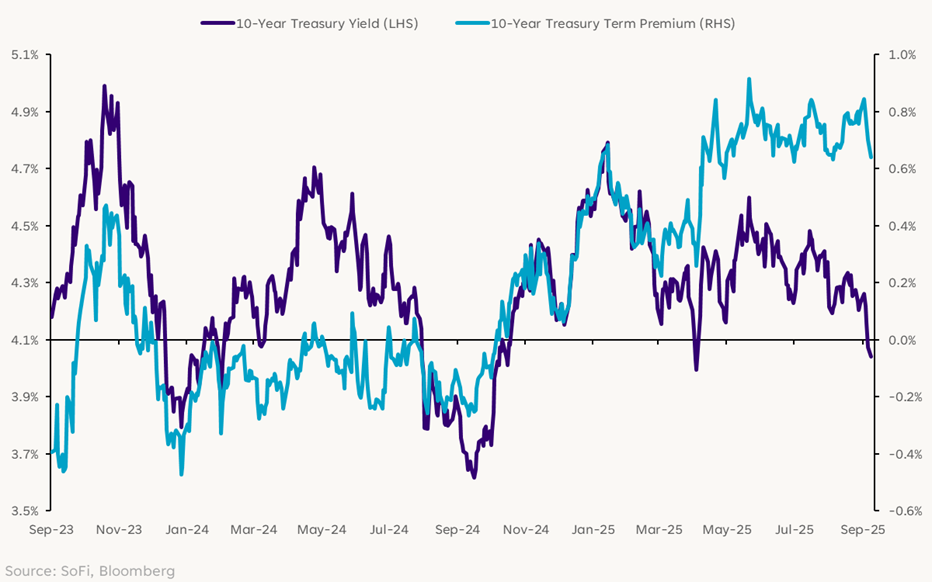

Consequences of this could seem abstract, but they’re very real. U.S. Treasury yields serve as the benchmark “risk-free” rate upon which nearly all other interest rates — for corporate bonds, mortgages, auto loans, and other forms of credit — are based.

If investors have less confidence that the Fed will act in the best interest of the economy, they may demand a higher term premium to compensate for the increased political risk and uncertainty. That’s already begun to happen, and as we know, higher interest rates generally mean slower economic growth and downward pressure on asset valuations.

10-Year Treasury Yield & Term Premium

In today’s market environment, political pressure on traditionally nonpartisan institutions like the Fed and the BLS will probably continue weighing on the U.S. dollar. That could benefit portfolios with exposure to international equities and dollar-denominated commodities like gold. On the other hand, the specter of rising term premium somewhat limits the upside of longer-term Treasurys given the political headline risk.

It can be challenging to invest in the present while having an eye on the future, but that’s what makes long-term investing so rewarding (and fun!) Stay diversified. Stay invested.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.