How To Reduce Investment Risk?

Whenever you make an investment in a stock, you are incurring risk. After buying a stock, there is a chance that it could decrease in value, rather than increase in value. There are ways, however, to decrease the presence of risk in your investments. Investors achieve this through asset diversification.

Say you are betting on horse racing. You could put all your money on one horse and potentially win big, yet risk losing it all if you are wrong. Or you could spread your money among multiple horses, decreasing your risk, while still inviting the possibility of success.

Ways of achieving a diverse portfolio include investing in companies that are based in different countries, owning stock in both small and large companies, and lastly investing in companies that operate in a wide array of industries.

You may not want your assets to be too similar nor do you want them to be all in the same place. This is where correlation comes in.

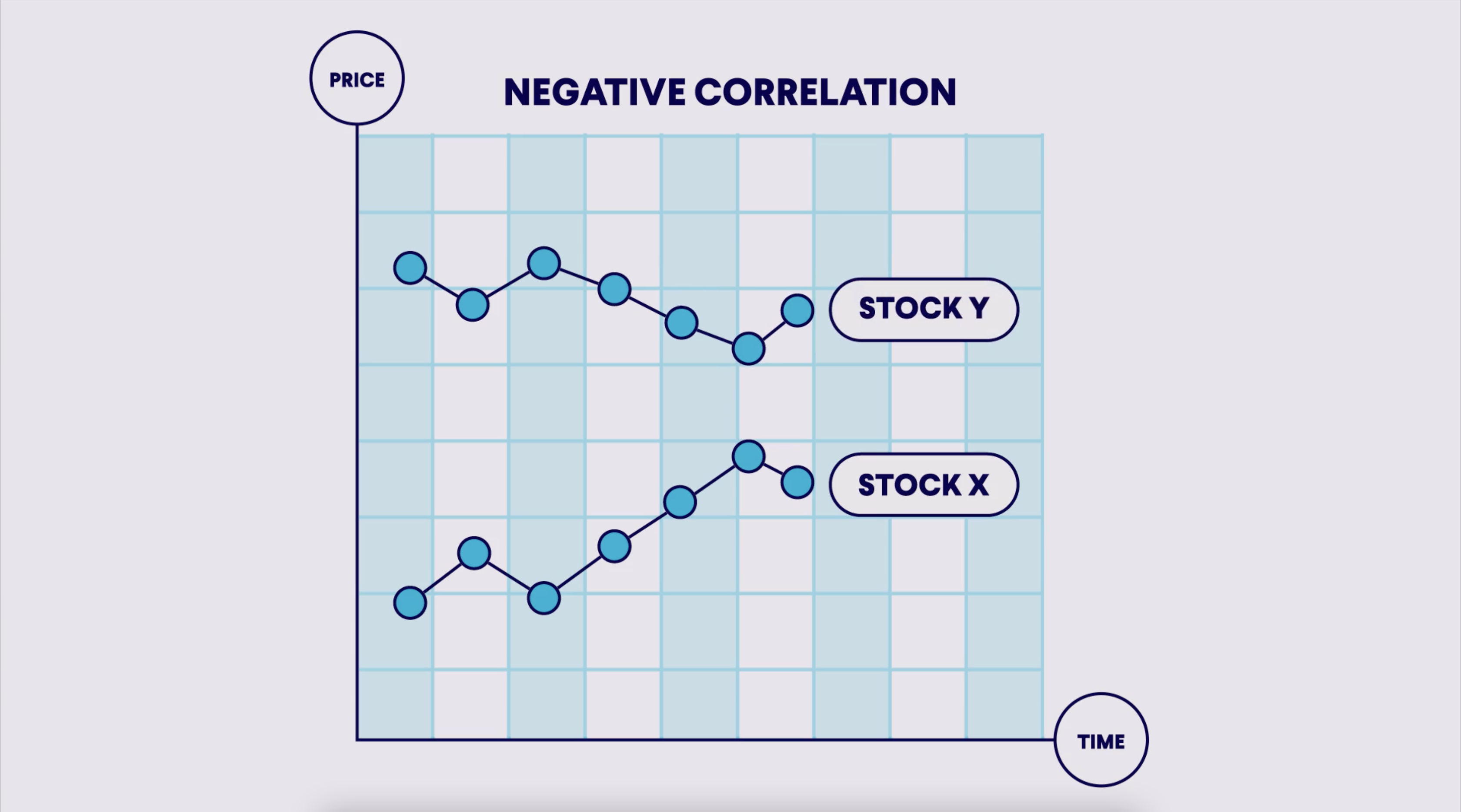

Understanding Correlation

Correlation is a value that represents what happens to the remainder of assets in a portfolio when one asset changes in value. It is measured on a scale from minus one to plus one.

A negative correlation indicates that when prices change, they move in opposite directions, whereas a positive correlation means that prices fluctuate in tandem.

If you have a portfolio of investments with assets that carry a negative correlation, this means that if a particular investment begins to decrease, another would begin to increase. Correlation is what makes diversification a safer option when investing.

There are, however, some drawbacks to diversifying your portfolio. Let’s say you begin to see one of your investments start to significantly increase in value. If you had a diversified portfolio, you wouldn’t be making as much money as you could be compared to if you had invested solely in that stock.

Alternatively, if you only owned that single stock and the market took a turn for the worse, or the company went out of business, you would lose much more money than if you had diversified your assets.

Diversification does not eliminate risk entirely. It does, however, minimize the impact that random events may have on your investment.

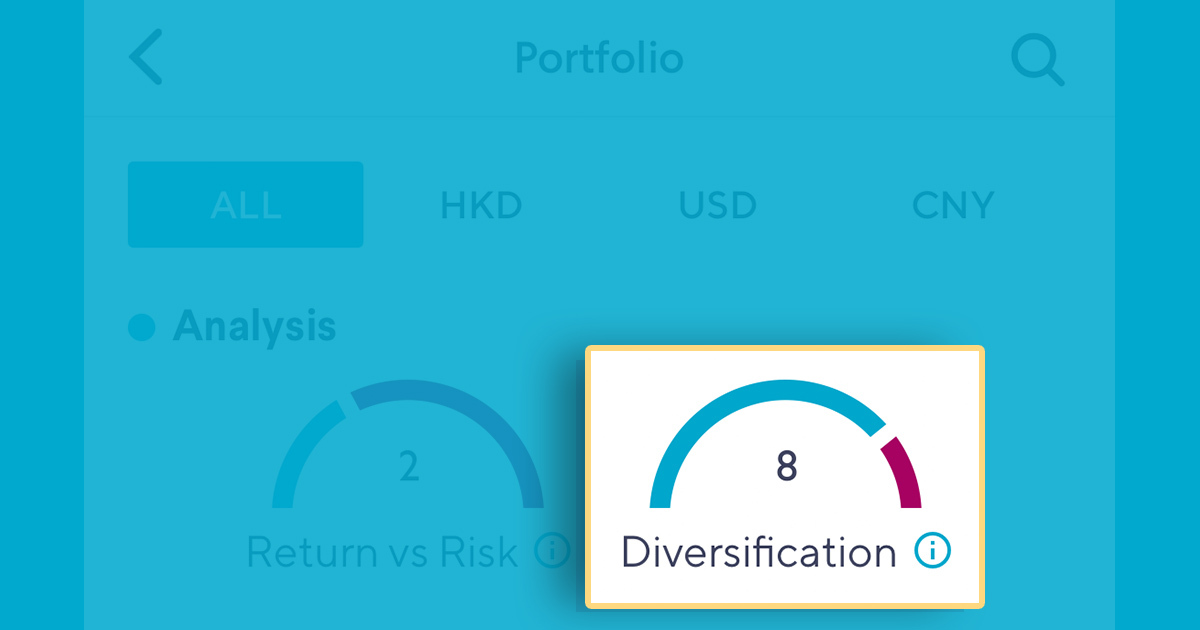

All of this may seem overwhelming, but this process is made simple when making investments through the SoFi Hong Kong app. Included within the app is a diversification algorithm that automatically calculates the level of diversity among your investments and returns a score.*

The value is represented on a one to ten scale with one being an indication of directly correlated assets, and ten representing uncorrelated assets.

The algorithm is calculated from the historical returns of your portfolio to determine whether they are correlated or not.

*The in-app Diversification Score (“The Scores”) are assumed figures presented for informational purposes only, and are neither an indication, prediction, forecast nor guarantee of future performance results of an investment, and may differ to the original formula. The Scores are based upon sources of information believed to be reliable. Such information and Scores have not been independently verified and the SoFi Hong Kong makes no guarantees to their accuracy, completeness, timeliness or correctness.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.