Looking at: The First Fed Meeting of 2026

Estimated reading time: 5 minutes

Plausible Pause

The media tried to pull Federal Reserve Chair Jerome Powell into the politically hairy topics — including the possibility of him staying on the Fed’s Board of Governors after his chairmanship ends — but he stayed firm in his refusal to comment. No fighting words or juicy headlines to be found here (sigh).

However, there are always some nuggets of excitement on Fed day (more on that later.) First, the basics: Officials kept rates unchanged for the first time since their meeting in July. No surprise, given markets had priced in a near-zero probability of a rate cut.

The stock market wasn’t surprised either, with all three of the major large-cap indices remaining relatively flat for the afternoon. Of course, stocks are always top of mind for investors, but the story they need to pay close attention to this year is bond yields.

Once again, the 10-year Treasury yield saw swings after the Fed statement, but ended the day very close to where it began. Sounds like no big deal, but when you consider that the yield is more than 25 basis points above where it was in late October, two rate cuts ago, it appears to be responsive to everything but the Fed.

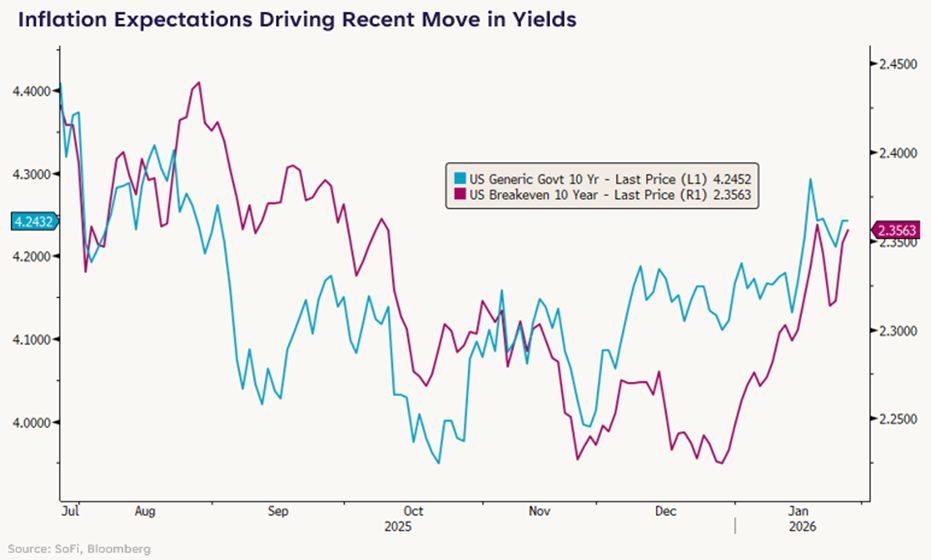

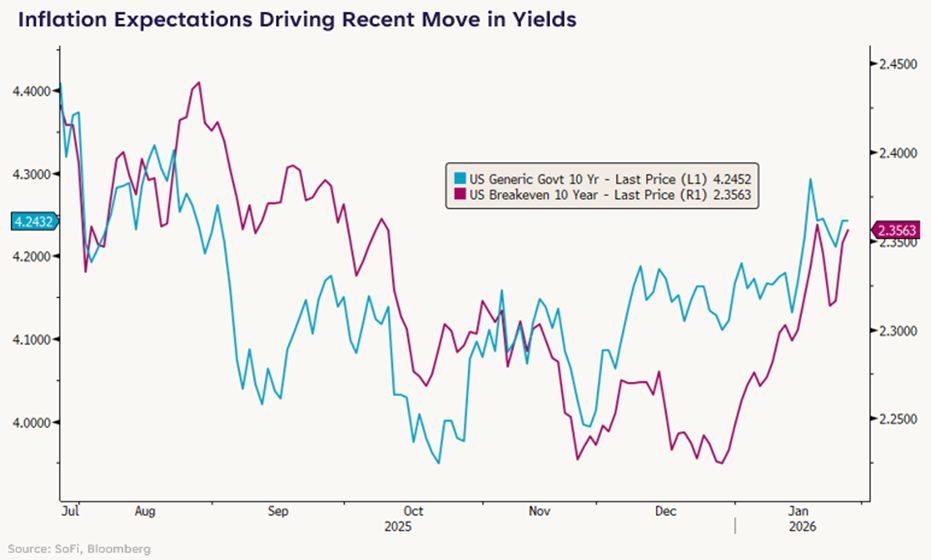

Moreover, inflation expectations (shown below with the 10-year breakeven rate) have risen year-to-date — not to concerning levels — but higher nevertheless.

While this chart suggests markets aren’t convinced that inflation won’t rear its ugly head again, Powell seemed relatively unbothered by inflationary forces and even pointed out that long-term expectations are still consistent with achieving the Fed’s 2% target over time.

There’s no way to know who will end up being correct, but this remains a sticking point in markets and something that may drive hotter debates as the year goes on.

Business as Usual

In other parts of the market, investors seemed to operate as if nothing had happened at all. Gold had another stellar day — which lately puts it in the camp of “business as usual” — reaching almost $5,400/oz. Meanwhile, small-cap stocks have been more or less flat over the last handful of trading days.

When Powell was asked about the major moves in gold and silver, he said not to take much macroeconomic messaging from them. That may be true (neither of these metals seem to be closely tied to macro forces right now), but there is certainly some message to be found. Perhaps it’s partly momentum and partly inflation concerns, but given the big gains today could it also be a sign of continued fears over Fed independence? Regardless of the main driver on any given day, investors just can’t get enough gold.

As for small-caps, for a long time the theory was they’d do well because the Fed was lowering rates… But markets don’t expect another rate cut until June or July and yet small-caps have outperformed large-caps by 500 basis points year-to-date.

Despite no changes from the Fed today and a market that has had to digest the idea of fewer rate cuts than it originally thought, small-caps have done just fine and operated in “business as usual” mode on Fed day.

Define Plausible?

The last nugget from today: Powell’s statement that the fed funds rate is currently “within a range of plausible estimates of neutral.” In other words, we’re close to finding our stopping point.

We’re surprised market pricing didn’t move more in reaction, to price out more future cuts. In any event, this signal that the Fed is close to or at neutral is an important one for investors. We’ve been relying on monetary policy to either drive or support stock prices for a long time, and we may now be in a phase where stocks will have to get by without continued rate cut expectations. We believe stocks can do just fine without many more cuts, but we’re just one person and many others may disagree. Markets will be the final judge.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.