Looking at: Kicking Off 2026

Estimated reading time: 5 minutes

Turn Around, Bright Eyes

“Every now and then I get a little bit restless and I dream of something wild.” That’s a lyric from Bonnie Tyler’s “Total Eclipse of the Heart” (a total solar eclipse is in fact coming in August), and we can’t think of more appropriate words to describe the start to this year.

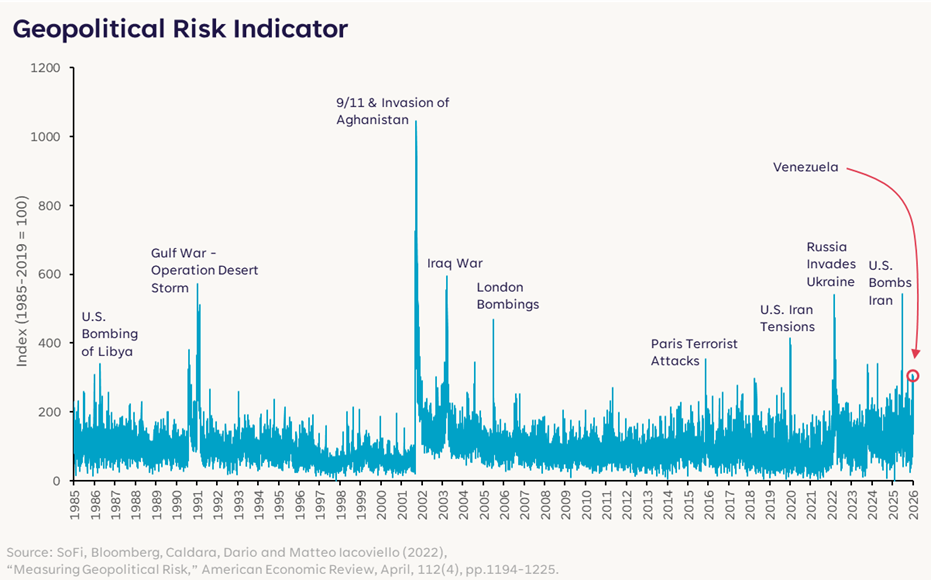

The events in Venezuela last weekend kicked off 2026 with a flurry of headlines and a spike in geopolitical risk. As the world waits for more of the story to unfold and markets try to digest if and when there might be opportunities as a result, this is a good time to remind ourselves that spikes in geopolitical risk are a mainstay of our current regime, and markets tend to send clear signals after those spikes.

Let’s first look at the recent spike in geopolitical risk stemming from the U.S./Venezuela escalation and how it compares to prior global events.

The size of the spike is notable, but not alarmingly large. That doesn’t mean it’s inconsequential, but it does put into perspective the importance of not overreacting to an event that may not end up being as immediately impactful as it first seems.

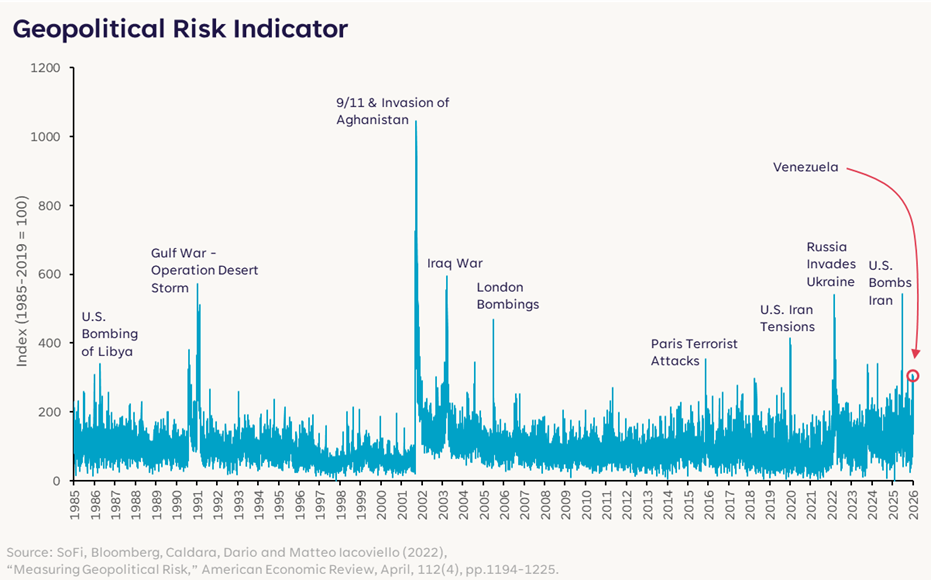

The next chart, however, is perhaps the most interesting for investors.

In the one-year period following spikes in geopolitical risk, cyclical stocks tend to handily outperform defensive stocks. In other words, markets become more optimistic following increases in geopolitical strife. Some of that likely stems from a sense of relief once the incident is over, but it also be because there’s greater clarity and/or a partial resolution.

As such, we are keeping an eye on the Energy sector and oil prices, and any additional details that roll in regarding this conflict, but staying the course in 2026, as outlined in our annual outlook.

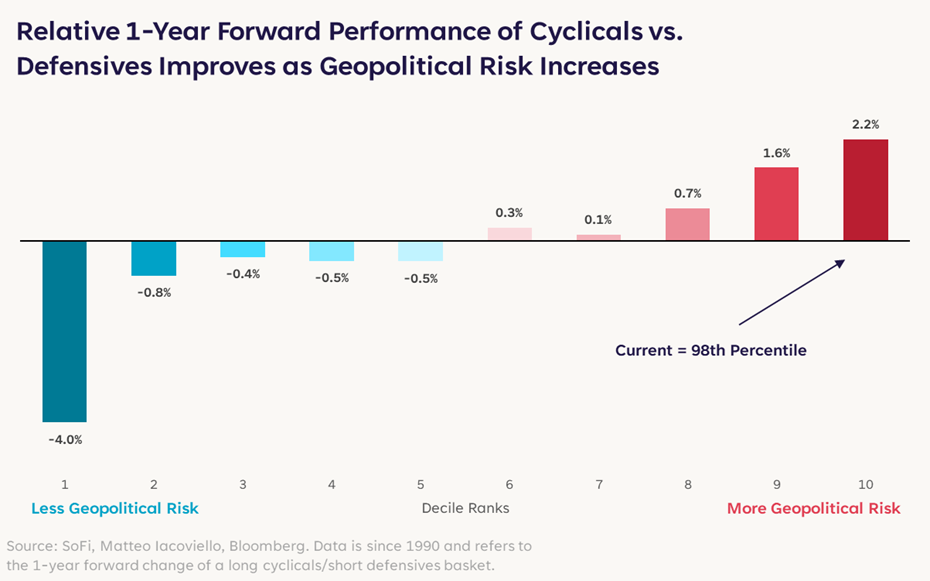

The Year End Un-Rally

Since the year-end rally investors were looking for didn’t materialize, the best Tyler lyric might have been “Every now and then I get a little bit nervous that the best of all the years have gone by.” With the S&P 500 down 0.1% during the typically favorable timeframe referred to as the Santa Claus rally, it was the third year in a row we had a Santa Pause instead.

As investors we are constantly looking for indicators that might give us a glimpse of what’s to come in markets. Perhaps the success or failure of the year-end rally has had some predictive power in the past, but my personal opinion is that it really doesn’t matter for what might happen in the following year. In fact, we think a year-end move in markets has much more to do with repositioning and tax strategies these days than sentiment and outlook.

The Best Broadens Out

The last couple weeks may have been disappointing and nerve wracking for investors, but I believe the market environment remains resilient and positive. As the AI theme matures and productivity continues to improve, markets can reap the benefits in a broader swath of sectors and groups, even with some intermittent breakdowns in beta like we experienced in 2025.

Happy New Year to all, and we look forward to an exciting 2026.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.