Decoding Markets: A New Golden Rule

Estimated reading time: 8 minutes

Oooh Shiny

Gold has always been synonymous with luxury. Jewelry, family heirlooms, treasure, you name it. In the distant past, it was even used as currency. Yet for many modern investors, gold occupies an uncertain space. Unlike stocks or bonds, it doesn’t offer cash flows or interest payments, and unlike many major commodities, it has few productive use-cases.

In markets, however, price is the ultimate arbiter of truth, and what’s been happening in gold markets has been a sight to behold. After steadily climbing in value in 2023 and 2024, price appreciation is now accelerating at a breakneck pace, naturally capturing headlines and intense interest among retail investors. Given this newfound attention, how should investors approach gold and its place within an investment portfolio? To get to the bottom of this, let’s start with the basics.

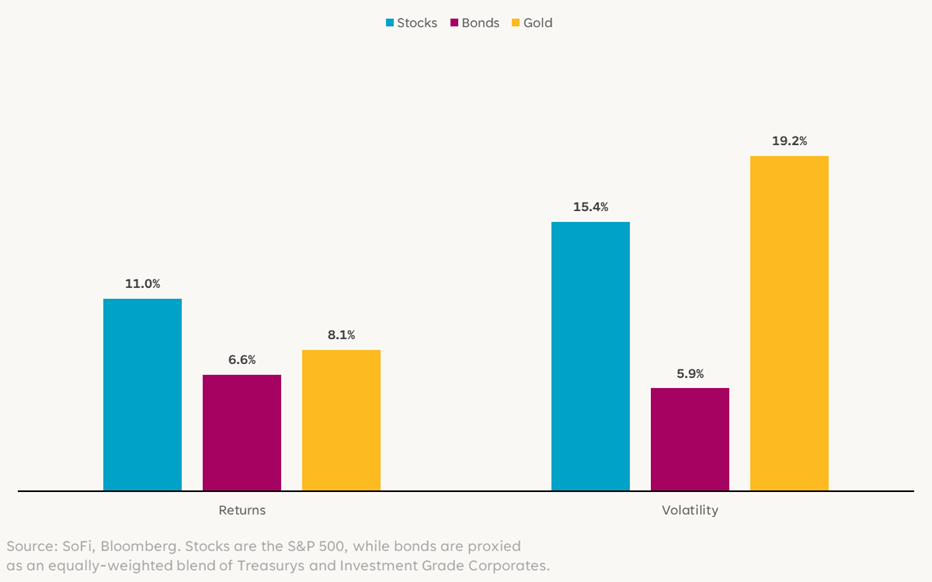

One common critique of gold is that it offers no real yield – “It’s just a shiny rock,” many say. That’s valid, and yet it’s averaged annual price appreciation of 8.1% since 1972. Clearly, there’s something about gold.

Of course, return is only one side of the equation. The other is risk, and another common critique is that gold is too unpredictable and volatile to warrant a meaningful allocation in an investment portfolio.

Gold certainly can exhibit significant price swings in the short term — especially considering the wonky supply-demand dynamics of commodity trading — but longer-term perspective provides crucial context. Since 1972, gold’s annualized volatility has been approximately 19.1%, somewhat higher than the S&P 500’s 15.4% over the same period.

Annualized Statistics

But even that isn’t the entire story. Diversifying is about allocating your money across sectors, geographies, and assets, but it’s not just about owning different assets. It’s also about owning assets that behave differently in different environments.

In other words, correlation. Two assets that have the same risk-return profile over the same period of time can actually have diversification benefits if they are weakly or negatively correlated to each other. On the other hand, two assets with wildly different risk-return profiles can have little diversification benefit if they have a strong positive correlation.

Gold has a famously unstable correlation to stocks (-0.01 since April 2021), which supports the idea that it adds a je ne sais quoi to portfolios. It has allowed gold to perform well across different macroeconomic environments, acting as a safe haven during periods of financial stress and as a hedge alongside other real assets during bouts of inflation.

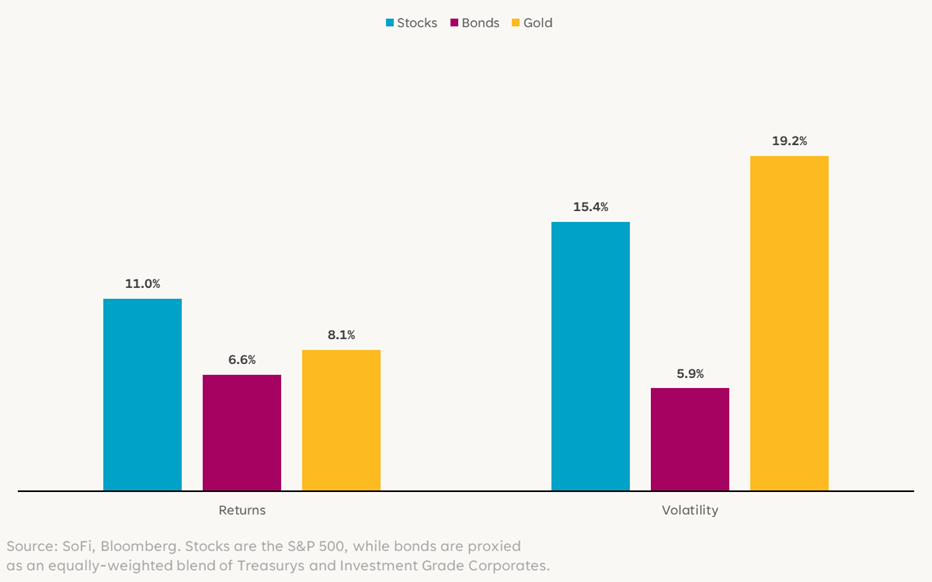

Same Metal, Different Drivers

Over the past two decades, one of gold’s strongest drivers was its inverse correlation with real (i.e. inflation-adjusted) interest rates. The inverse correlation is because, as we’ve noted, gold is a non-yielding asset. In other words, its real yield is and always will be 0% (technically slightly negative due to storage costs, but that’s just being nitpicky). As interest rates decline, that 0% becomes incrementally more attractive, and as we saw in 2020, real Treasury yields can even fall into negative territory! That 0% starts to look a lot better in those situations, doesn’t it?

Gold Is Inversely Correlated With Interest Rates

This long-standing relationship has broken down in recent years, however. Even though real 10-year yields have increased to 1.73%, well above prior year levels, gold has rallied to all-time highs. The definitive break in this relationship can be traced to the fallout from Russia’s invasion of Ukraine in February 2022. The U.S. and its allies imposed sweeping financial sanctions, including freezing nearly half of the Central Bank of Russia’s foreign currency reserves.

This weaponization of the U.S. dollar triggered a strategic pivot among global central banks to reduce exposure to the dollar and its associated financial infrastructure. The drumbeat of global upheaval since then has only furthered that trend, with gold being the primary beneficiary. Unlike Treasuries or other foreign currency reserves, physical gold held in a country’s vaults can’t be easily frozen or seized. It’s a neutral, universally accepted store of value, which makes it attractive in an uncertain world.

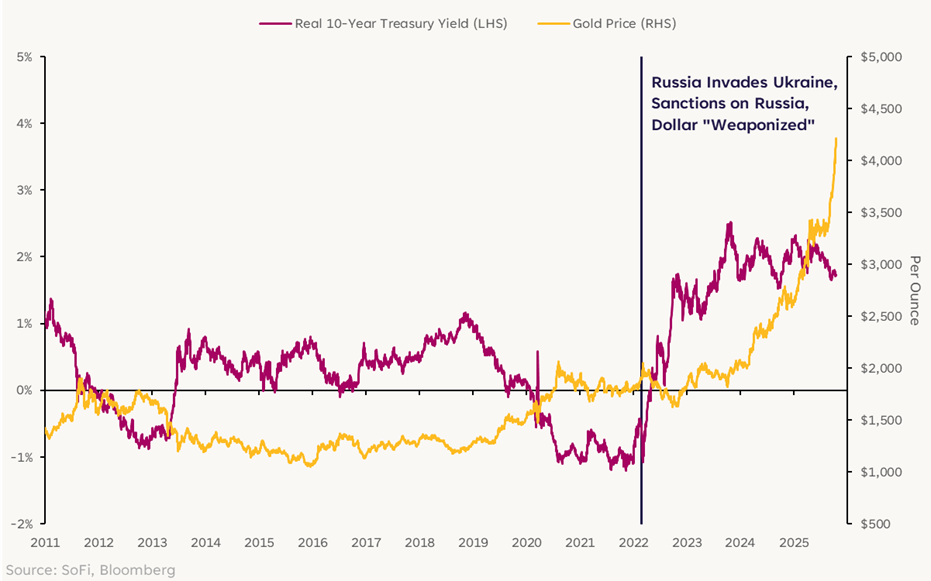

The scale of this shift is staggering. Before sanctions, central banks accounted for 11% of gold demand, but since then central bank demand for gold has doubled.

Quarterly Purchases of Gold by Central Banks

What’s most important about this shift is that unlike most buyers of gold (or really any commodity), central banks and government entities are fundamentally price-insensitive. They’re accumulating gold to buffer foreign reserves against perceived long-term geopolitical risks. This steady sovereign demand effectively has put more of a floor under gold prices, evidently more than offsetting the traditional headwind from high real yields.

Gold Rush

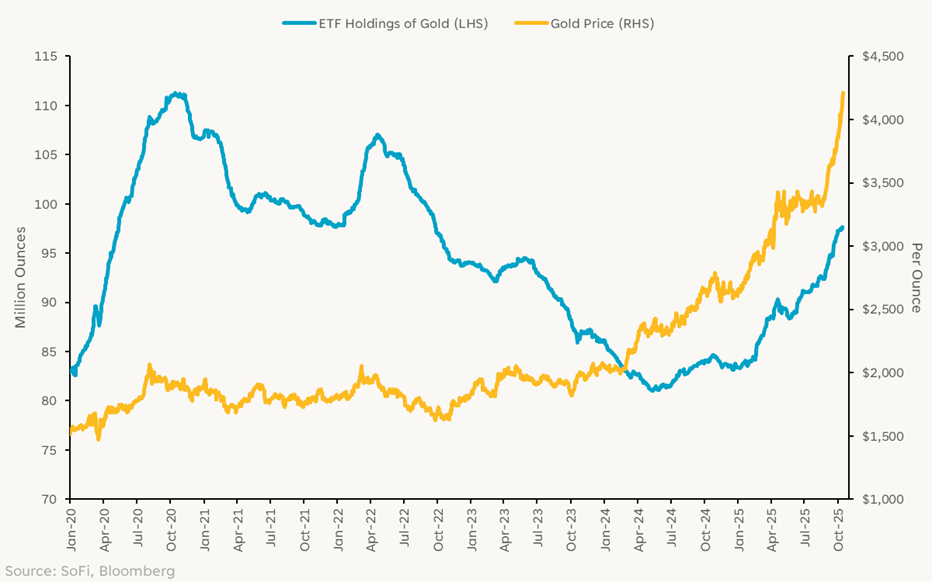

One would think that the increase in gold prices would have also enticed retail investors to increase their allocation to the asset, but ETF holdings of gold actually declined 24.3% in 2022 through mid-2024, likely driven in part by the old interest rate playbook.

With investors adapting to this new world, gold has hit a second gear with retail and institutional investors alike now seemingly returning in force. September marked the largest monthly inflow into global gold-backed ETFs on record, capping the strongest quarter for inflows.

Broadening of the buyer base from sovereign to financial participants has helped boost gold prices even further. Year-to-date price returns now stand at 59.9% as of October 15, one of the best years on record. Despite the strong price momentum, however, total holdings in gold ETFs are still 12.3% below their highest levels in 2020-21. A simple read here might suggest there could still be some room to run.

Investors Are Chasing Gold Prices

Looking at gold’s relationship to other assets can help provide some color on the character (for lack of a better word) of the market backdrop. One such relationship is the ratio between copper and gold prices. Comparing copper, an industrial metal that thrives when the global growth backdrop is strong, to the ultimate safe-haven asset can signal how market participants view things. The ratio is at its lowest levels ever, suggesting a decidedly fearful, risk-averse tone.

Copper/Gold Ratio

Of course, periods of major upheaval like the last few years can disrupt longstanding relationships, blurring the line between signal and noise. Nevertheless, a defensive message here makes sense given all that’s occurring in the world – ongoing global trade upheaval, raging budget deficits, and currency debasement, just to name a few.

To Allocate or Not to Allocate

We’re left with a few takeaways.

- Gold’s long-time role as a portfolio diversifier not only remains intact, but might be more critical than ever in an era where inflation is sticky and stock-bond correlations might be less negatively correlated than in the last few decades.

- Global central banks have emerged as a powerful and price-insensitive source of demand for gold that is likely not going away anytime soon.

- Market signals suggest that investors have priced in, and are continuing to price in, the changing dynamics around gold.

Some of the best investments often involve stories where long-term trends collide with short-term catalysts. The secular story behind gold demand is clear enough, while the prospect for further interest rate cuts or a slowdown in GDP growth could push real Treasury yields lower, which (in a throwback to the old playbook) could be further fuel for the precious metal.

No one individual’s financial journey is identical. Risk tolerance differs. Life plans differ. But generally speaking, a strategic allocation to gold in investment portfolios just makes sense right now.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.