Looking At: Markets During a Shutdown

Estimated reading time: 5 minutes

Closing Time

We’ve become accustomed to government funding debates and the drama as we approach each potential shutdown. Typically, they’re “solved” in the 11th hour. Not this time.

For the first time since 2018, the U.S. government shut down due to unresolved funding arguments between Democrats and Republicans.

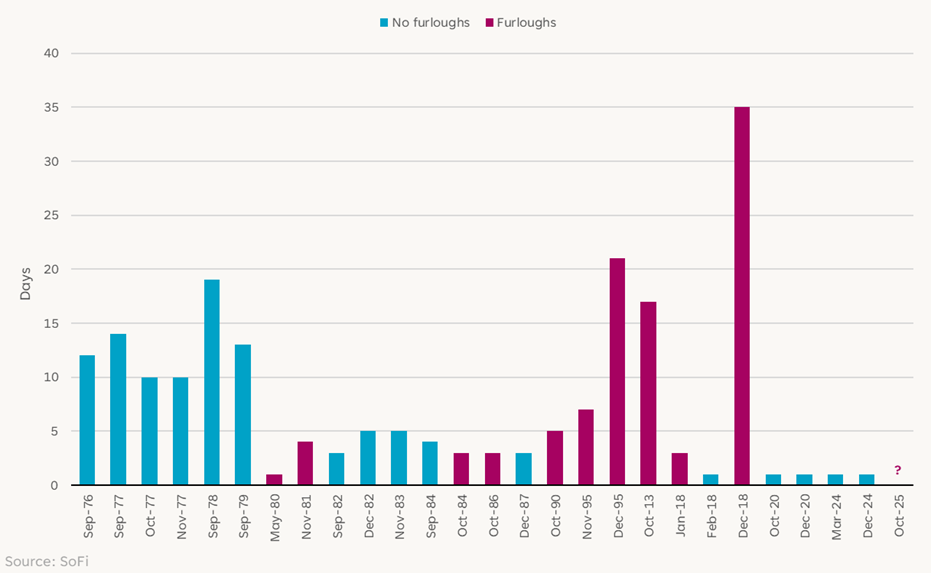

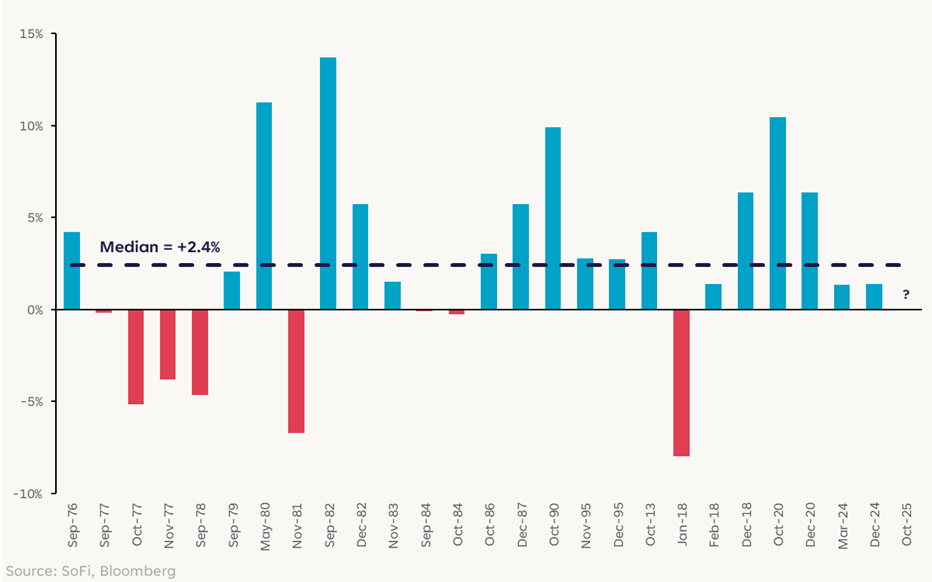

Government Funding Lapses

However, this shutdown comes with a much different backdrop than 2018, which lasted 35 days: Markets have been strong, the Fed just cut rates, and the unemployment rate is rising. The opposite was true on all three accounts in 2018.

From an investor sentiment perspective, we’re in much better shape today than we were then. Late 2018 was marred by a confusing message from the Fed and rate hikes that fueled a swift market sell-off of nearly 20% in the fourth quarter. Much like today, the Fed was on a normalization path, but it was hiking rates from a historically low level.

Now the Fed is cutting to normalize rates as the economy cools and inflation pressures abate. This is not to say that a government shutdown is no big deal. It is a big deal and it has many consequences. But given the supportive sentiment backdrop, we may be able to manage through this in markets.

Friday Is Cancelled

One of the wrinkles investors may have to contend with is that the Bureau of Labor Statistics (BLS) won’t release economic data during the government shutdown. The next jobs report, due out this Friday, is an important piece to the Fed’s rate cut puzzle. Markets are watching this data closely, especially after large downward revisions in the prior few months and the recent firing of the head of the organization.

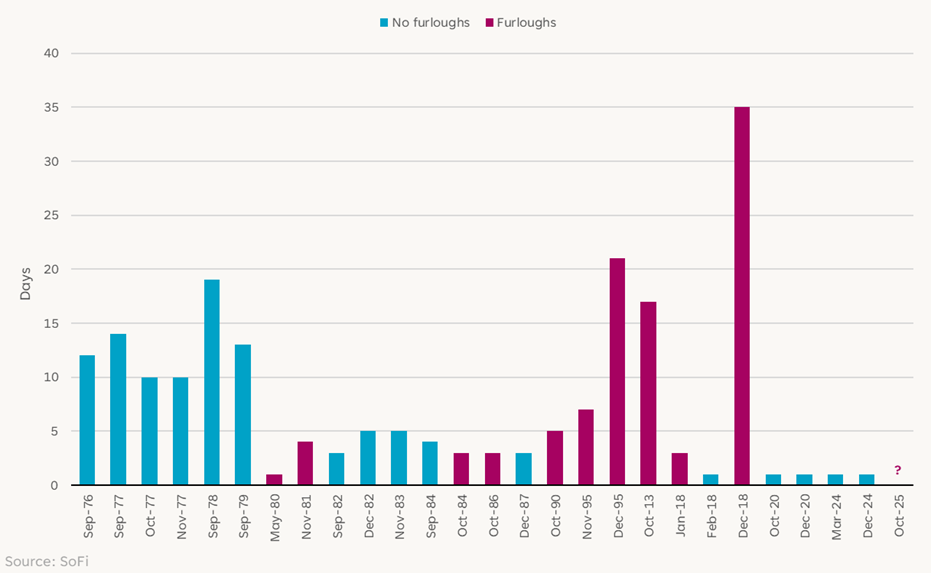

If the ADP employment report (a private sector survey that does get released during a shutdown) is any preview, the labor market continued to cool in September. It’s worth noting, though, that the ADP and BLS data don’t usually show a clear relationship and can often paint very different pictures.

ADP Private Employment Change

Adding to the muddiness is how the shutdown may affect the labor data for October. Even if short-lived, government shutdowns typically result in furloughs of federal employees. Though markets have historically done fine during and after a government shutdown (more on this below), this is an inconvenient time to have less visibility into labor data.

Distraction More than Detraction

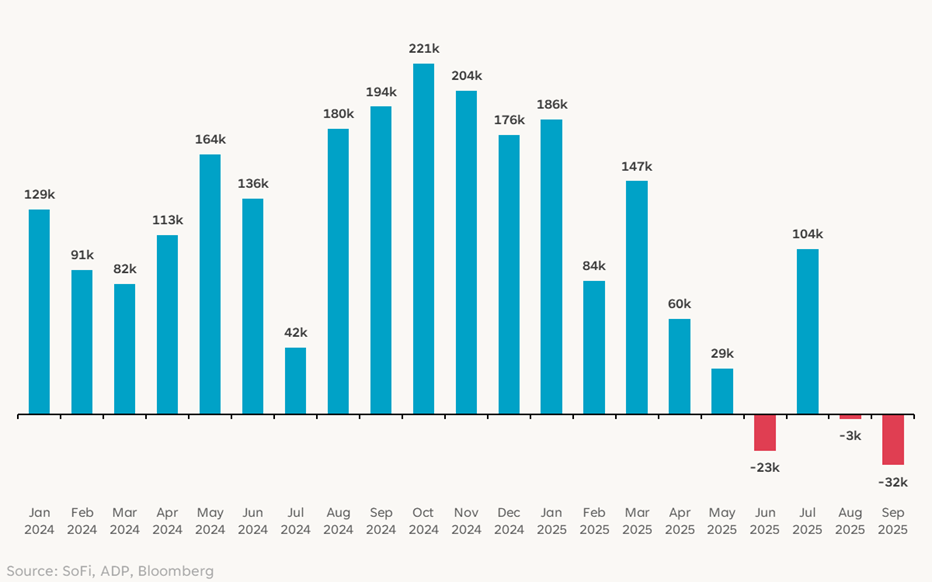

Over the past 50 years, the government has shut down 20 times for an average of eight days each time. As unsettling as a shutdown may be, markets have weathered the storms quite well.

The chart below shows S&P 500 performance for the three months following the end of each shutdown, with a median return of 2.4%. In all of these cases, there were other things going on in the background that affected markets, but it’s important to note that the shutdowns didn’t seem to be the instigator of major drawdowns on balance.

S&P 500 3-Month Price Return Post-Shutdown

I’m writing this column on day one of the shutdown, so there are still many unknowns. Some believe this could last 3-4 weeks and result in permanent layoffs (rather than furloughs), but the reality is we really don’t know. What we do know is that it’s very possible, if not probable, that political polarization will continue. So markets will need to digest ongoing policy uncertainty.

Although frustrating for investors to live through, markets have looked through shutdowns in the past, regarding them more as distractions than serious volatility triggers. With this in mind, a steady hand is crucial. It’s important to resist any knee-jerk reactions during the early days. Stay prudently present in markets.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.