Looking At: The Fed’s September Statement

Estimated reading time: 0 minutes

Cut Loose

While the Federal Reserve’s 25 basis-point rate cut today was not a surprise, there were some surprises in the details behind the move.

The Fed also released an updated Summary of Economic Projections and dot plot, both of which showed notable changes.

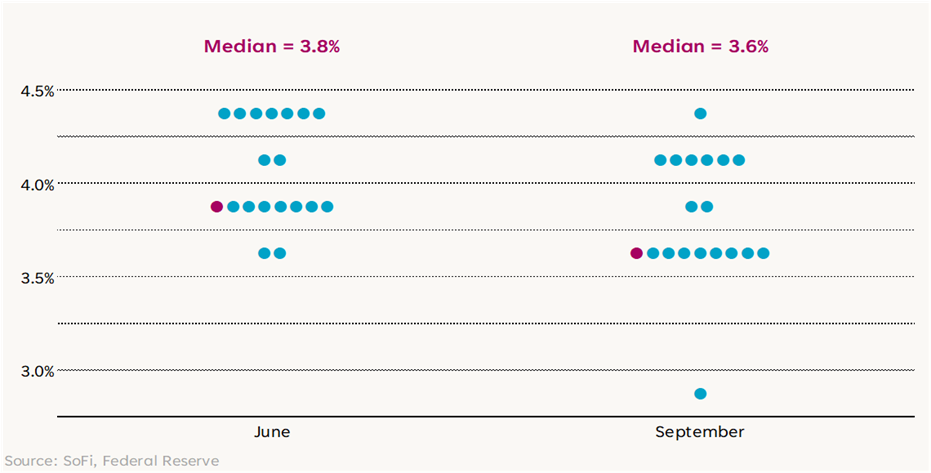

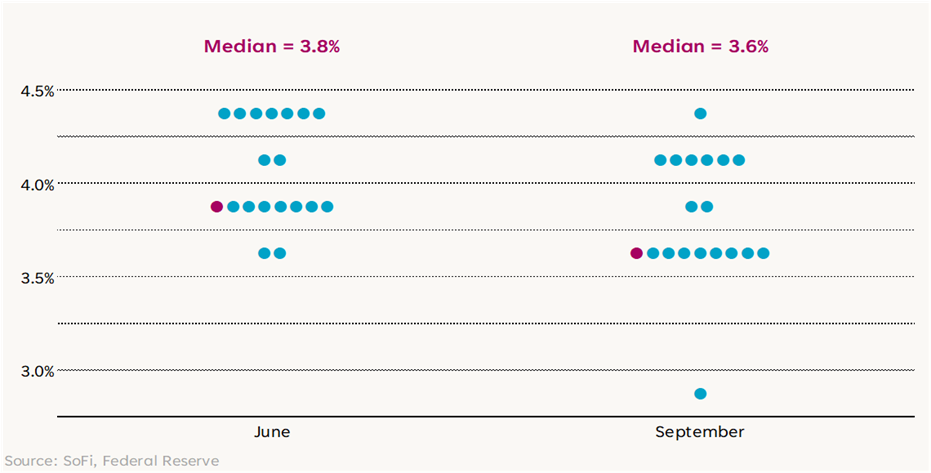

The dot plot is an illustration of where each Fed official sees the fed funds rate moving this year and in the years ahead. This is our best view of how much consensus there is around monetary policy and the trajectory of rates in the future. The dot plot showed that most voting members foresee ending the year at a lower rate than they saw in June. One voting member was an outlier, expecting an extra three rate cuts beyond what even the most dovish members of the committee expect.

2025 Dot Plots

As a result, the median expectation for cuts in 2025 moved from two to three, including today. If things were simple and straightforward, we might expect the stock market to like this news… After all, hasn’t it been clamoring for rate cuts most of this year? And hasn’t much of the recent rally been driven by the expectation that rate cuts were coming?

But the day closed with the S&P 500 and Nasdaq down slightly. One could argue that this Fed decision was already priced in, but even if that’s true, signals of a more dovish Fed theoretically should’ve pushed markets higher.

We believe markets ended the day confused by the contradiction between economic projections and rate expectations. Additionally, the debate over whether there’s too much political influence on the committee’s actions created more noise.

Relationship Problems

We often reference relationship problems when talking about markets because we believe it’s important to note when a relationship between two variables isn’t working as it usually does. In the case of today’s Fed meeting, there are relationship problems between the SEP and the committee’s rate projections.

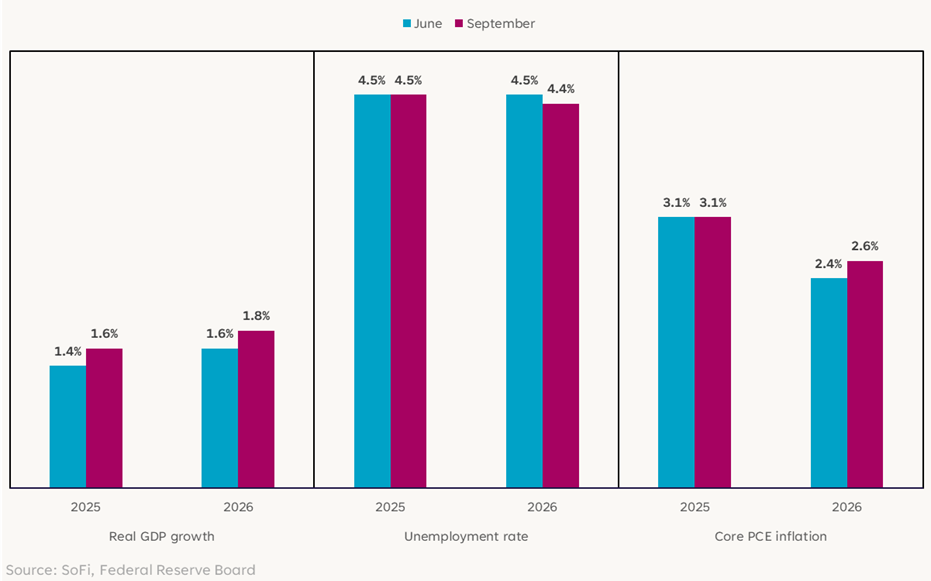

To summarize the chart below, economic projections didn’t change for 2025 but reflect a more optimistic stance for 2026: GDP growth expectations moved up, unemployment expectations moved down, and inflation moved up a bit (perhaps due to stronger growth.) This too should be positive news.

Fed Summary of Economic Projections

The problem is, the Fed’s rate projection moved down in both 2025 and 2026, meaning the committee sees more rate cuts coming than it did in June.

Why cut more if the economy is expected to strengthen and inflation is expected to rise? Something isn’t adding up. Not to mention, if the makeup of the FOMC changes next year to include more members who are expected to cut rates dramatically, the risk may be in cutting too much, which could stoke inflation.

Chase or Fade?

After today’s news, we believe the risks to markets will increase in 2026. But if we focus on the present, the big question to finish the day is: Will investors continue chasing the rally higher, or will the recent rally fade on the heels of this meeting?

For now, we think the market can continue moving higher, particularly the spots that are rate sensitive (Financials, Real Estate, small-caps) and that haven’t participated in the concentrated large-cap rally (Health Care, Materials). That said, it’s a prudent move to hold some assets that can dampen volatility (if it should arrive.) Despite its remarkable performance over the past couple years, gold still looks attractive from a demand and diversification perspective.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.