Decoding Markets: A Fed Divided

Estimated reading time: 6 minutes

Fractured Front

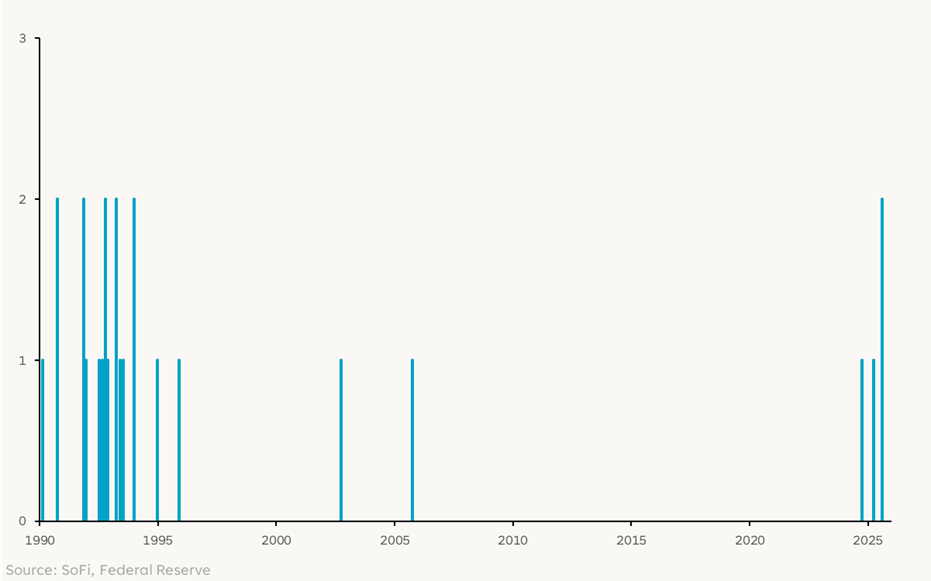

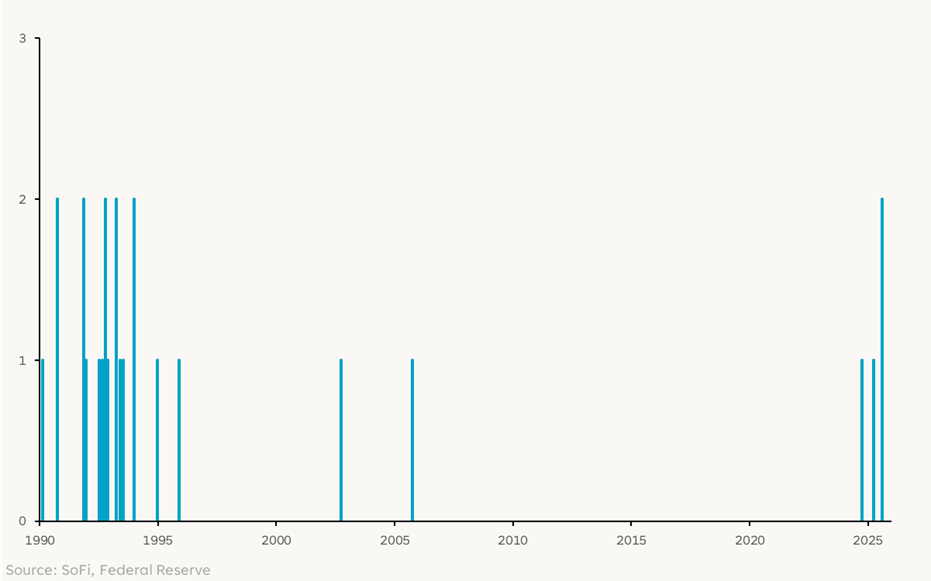

The Federal Reserve’s July meeting concluded with a decision that was both widely expected yet still surprising. As anticipated, the Fed held its benchmark federal funds rate steady in a target range of 4.25%−4.50% for the fifth consecutive meeting. The real story, however, was in the vote count. For the first time since 1993, two of the Fed’s governors cast dissenting votes, arguing instead for a 25-basis-point cut.

Number of FOMC Governor Dissents

The dissenters were motivated in part by the fear that the labor market is cooling more rapidly than the headline figures like jobs added suggest. Governor Christopher Waller — who is seen as a candidate to replace Chair Jerome Powell — has been particularly vocal, warning that private-sector job growth is “near stall speed” and that they “should not wait until the labor market deteriorates before we cut the policy rate”.

For those who voted to keep interest rates steady, the primary motivation is wanting more clarity on how tariffs will affect the economy. However, comments from Powell during the post-meeting presser suggest that clarity could take a while:

“But at the same time, there are many, many uncertainties left to resolve,” he said. “So yes, we are learning more and more. It doesn’t feel like we’re very close to the end of that process. And that’s not for us to judge, but it feels like there’s much more to come.”

An Economy of Two Tales

The divisions within the Fed are a direct reflection of mixed economic data that can be interpreted in different ways.

On the surface, the latest report on Gross Domestic Product (GDP) painted a picture of robust health. The U.S. economy grew at a 3.0% annualized rate in the second quarter, above consensus expectations for growth of 2.4% and a welcome rebound from the 0.5% contraction in the first quarter.

Beneath the surface, however, the picture gets more complicated. The GDP figure was artificially boosted by a massive 30.1% plunge in imports, which raised GDP by 5.7 percentage points (because net exports increased). In other words, the robust GDP print was less a sign of domestic strength and more a normalization after businesses frantically imported and stockpiled goods to get ahead of tariffs in the prior quarter.

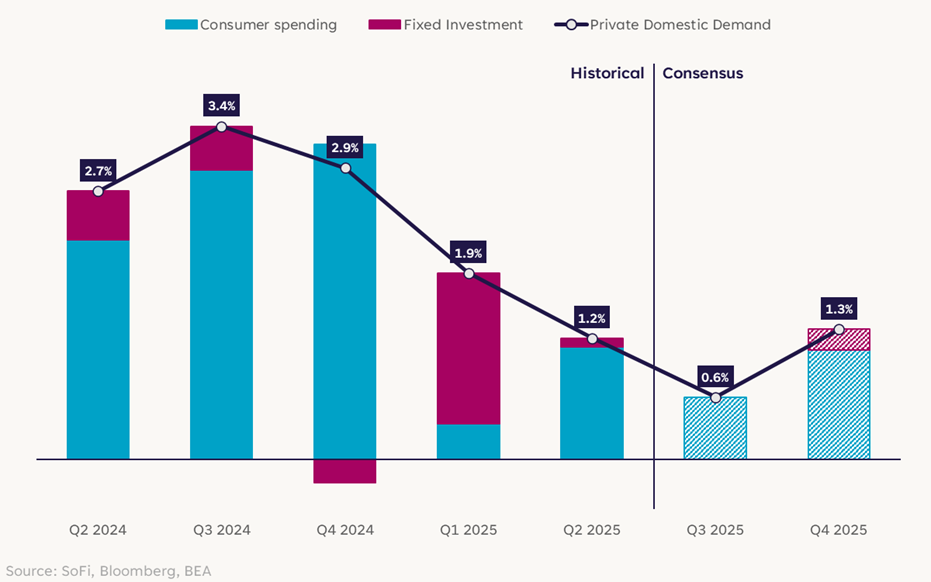

To get a more accurate gauge of underlying economic momentum, one can look at Final Sales to Private Domestic Purchasers (i.e. private domestic demand) which strips out government spending, trade, and inventories to isolate what consumers and businesses are doing. This measure tells a more sobering story: Entering the year at 2.9%, private domestic demand slowed to 1.2% in Q2 and is expected to slow even further next quarter.

Real Private Domestic Demand

There’s something to the idea that the economy is showing some cracks, but it remains to be seen how much more economic pain the Fed would be willing to tolerate to get the inflation clarity it’s looking for.

Investors Remain Optimistic, For Now

Despite everything, the U.S. stock market has remained remarkably buoyant. The S&P 500 has spent the month marching to a series of new all-time highs, powered by better-than-expected earnings results and relief that worst-case tariff scenarios were avoided.

While the stock market reaction to the Fed’s decision was muted — stocks finished the day mostly flat — the more telling reaction was from the bond market. The 2-year Treasury yield, sensitive to what the Fed does, ticked up by about seven basis points to end the day at 3.94%. Given Powell’s hesitance to hint at, much less endorse, a September rate cut, the move higher in Treasury yields isn’t a surprise.

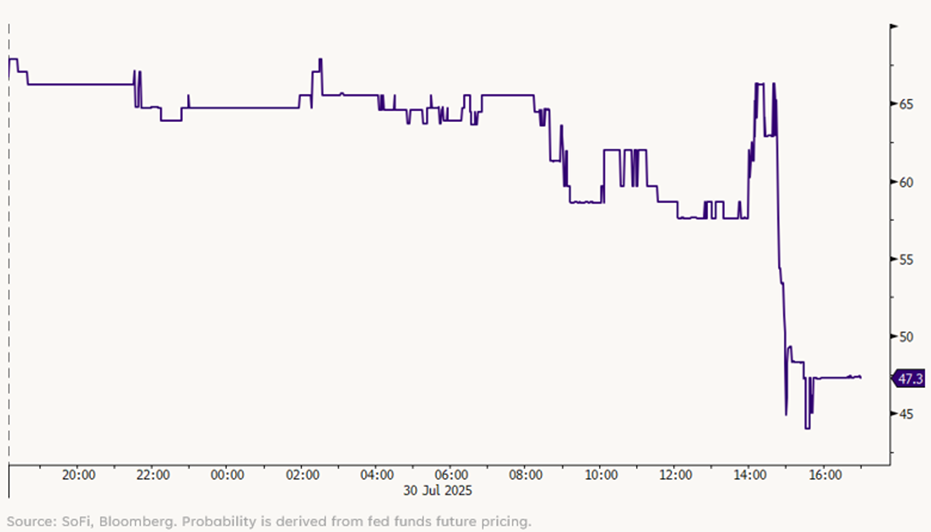

The age-old mantra for investors has been don’t fight the Fed. Yet in many ways that’s exactly what investors have been doing. Coming into Fed day, futures pricing indicated about a 65% chance of a rate cut at the September meeting. After the release of the Fed statement and post-meeting press conference, that has fallen to 47%.

Probability of a September Rate Cut

In essence, investors have been siding with the dissenters, betting that weakening economic growth and no persistent tariff-related inflation will push the Fed to cut rates, regardless of its current rhetoric. This sets the stage for a data-dependent showdown over the next two months. If the next inflation reports show increasing tariff impacts, or labor data remains solid (we get a big update on Friday with the monthly jobs report!), it could force a rapid repricing of rate cut expectations beyond what we’ve already seen.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.