SoFi Looks at: Early Year Announcements

Estimated reading time: 5 minutes

Lay Off the Optimism

The labor market has been a standout overachiever in macro data this cycle, and continues to send signals of stability, at least according to the national numbers. A phenomenon that seems to occur every year is a string of layoff announcements in the first couple months as companies clear the deck and start a new budget year by “right sizing” their workforce.

This year has been no exception, and the headlines have done their job to make these announcements sound juicy. Many of the companies that have made notable layoff announcements are household names, which can sensationalize the news just by sheer familiarity with the brands. Companies such as UPS (UPS), Amazon (AMZN), Citigroup (C), Cisco (CSCO), Microsoft (MSFT), and Nike (NKE) are among the names on that list.

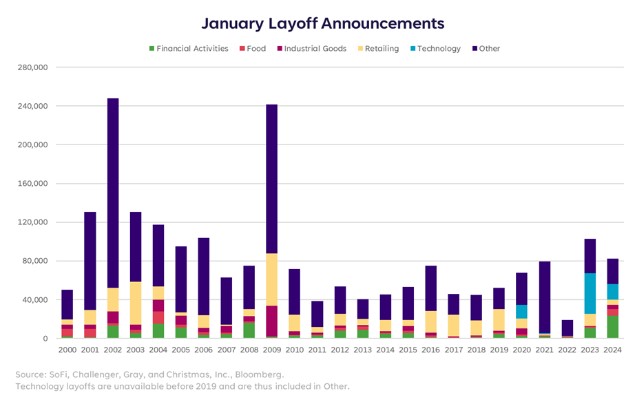

This got us wondering whether this year has had more layoff announcements than other years, or if the headlines are just doing a good job of keeping them top of mind. Although January 2024 has seen fewer layoff announcements than January 2023, the number was still higher than all other Januarys since 2009.

In a year when the consensus narrative has become that the economy is strong and resilient, inflation is putting less pressure on costs at the company and consumer level, a higher level of layoff announcements than what’s “normal” seems a bit contradictory.

This begs the question: Are companies seeing cracks in demand that warrant job cuts, or was the workforce still bloated from the post-pandemic boom? A labor market that was historically tight led companies to hang on to their workers at all costs out of fear that they wouldn’t be able to find new ones; perhaps this is just a normalization of a too-tight labor market.

But it’s not just that the absolute level is high, it’s that the composition of where the layoffs are coming from is more diversified than in previous years. That could suggest the layoffs are broad-based, which is more concerning than being able to explain them away as concentrated in one industry with unique circumstances.

Of course, each company’s reason for engaging in layoffs is different, and not all of those reasons are bad, so it’s impossible to lump them all into the same “warning” bucket. But this is a data point that at least suggests labor markets may not be as strong as we think.

Location, Location, Location

Turns out, your view of the labor market depends on where you live. If the consensus view has been that unemployment has stayed low, there are a healthy amount of jobs being added to the economy each month, and there are plenty of jobs available. That’s true on the national level when all 50 states are added together into one number. However, it’s not true in some of the states with the largest worker populations.

The three states: California, New York and Illnois account for 21% of the U.S. worker population and have seen steadily rising unemployment rates, as well as fewer jobs added. Meanwhile, the Texas, Florida Georgia have seen steady unemployment rates, or muted increases, and account for 19% of the U.S. worker population.

The national data published by the Bureau of Labor Statistics that aggregates all states still shows strong results despite these regional differences. That may be a decent read of the labor market at large, but it’s clear that certain areas are having a different experience.

What’s more is that rather than looking at the state-level data through the lens of “only a few big states are losing jobs”, a comprehensive picture shows that it’s shifting to “only a few big states are adding jobs”.

This wouldn’t necessarily be a concerning quirk in the data except that the states showing cracks are some of the largest and most economically important ones in the country. Time will tell if these big states will reverse course and stabilize, or if other smaller states will follow suit and weaken. Some investors have pointed to the state unemployment data as an inconsistency that warrants attention, and I would agree.

For now, these chinks in the armor simply raise an eyebrow. Later in the year we’ll find out if they were bigger warning flags.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.