Investment Strategy View: Earnings Strength

Estimated reading time: 5 minutes

Changing Seasons

Every year around this time, one can feel the seasons change. The coldest months are for the most part behind us, and our minds shift ahead to the coming spring. Parallels can be drawn to markets as well. Earnings come and go, and investors’ focus quickly shifts from the end of one quarters’ results to the fast-approaching next set of results on the horizon. That’s where we find ourselves today, with 99% of the S&P 500 having reported this season.

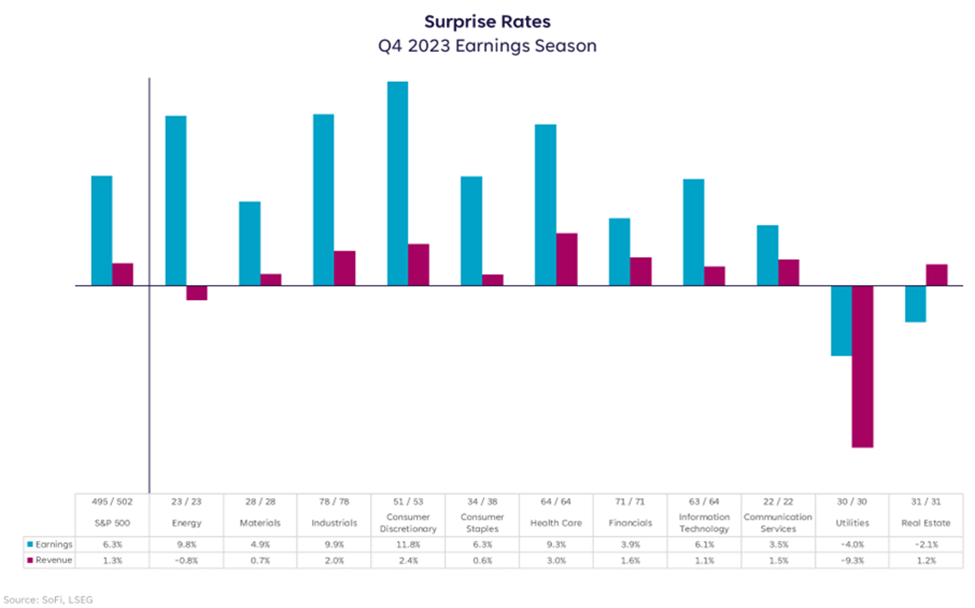

Coming into the Q4 2023 earnings season, consensus estimates were looking for year-over-year growth of 3.0%. That would have been slightly lower than the 4.3% we got in Q3, but still positive overall. Instead, we got earnings growth of about 10%, as almost every sector recorded stronger-than-expected results.

On average, 67% of companies tend to beat consensus estimates, so a surprise on the upside isn’t necessarily shocking. Instead, what’s particularly surprising is how they beat forecasts: While the revenue surprise rate was mostly in-line with the historical average, the earnings surprise rate was comfortably above it. This suggests that companies continue to be able to cut costs and/or raise prices beyond what market watchers thought possible. While it’s fair to wonder how much longer corporate America will be able to expand its profit margins, that day has decidedly not come just yet. In terms of where the surprises came from, the answer is more of what one might guess, which would be cyclical sectors and areas exposed to innovative themes that everyone has been talking about – artificial intelligence and weight-loss drugs.

Pulling Forward

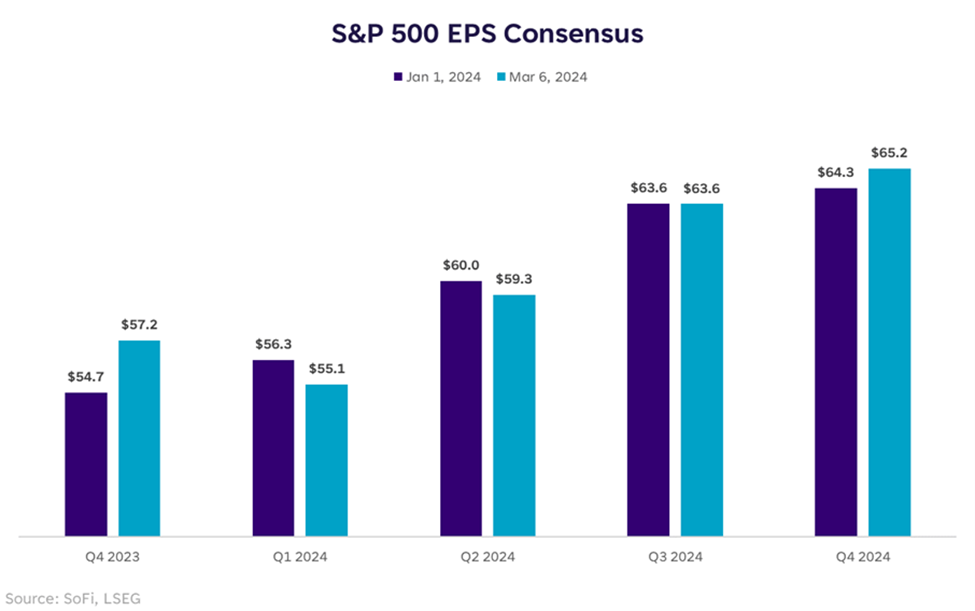

Given the upside surprise in earnings that we just got, estimates for upcoming quarters should be revised up, right? Not necessarily. While the past quarter saw earnings per share come in $2.4/share above the estimate at the start of the year, Q1 and Q2 2024 earnings are now expected to be $1.1 and $0.7 lower than what was initially thought, respectively. This indicates that some of last quarter’s strength likely came from pulling forward future earnings, which could just be a reshuffling and nothing to be too concerned about. At least that seems to be the consensus view, since earnings estimates for Q3 are flat while Q4 has actually been revised higher, despite the weaker estimates in the first half of the year.

The Magnificent Seven stocks were responsible for almost all of the earnings growth we got in Q4, as earnings growth for the “S&P 493” was barely positive. The Magnificent Seven are expected to notch EPS growth of over 39%, while other companies are expected to see earnings contract by 2.5%. But interestingly, the S&P 493 is expected to see stronger earnings growth as the year goes on, narrowing the gap between mega cap tech and everything else. A broadening out of earnings growth would be a welcome addition to this cycle.

Fedspeakonomics

Consensus estimates are currently pretty optimistic, and if 2024 plays out like that stocks could do pretty well.

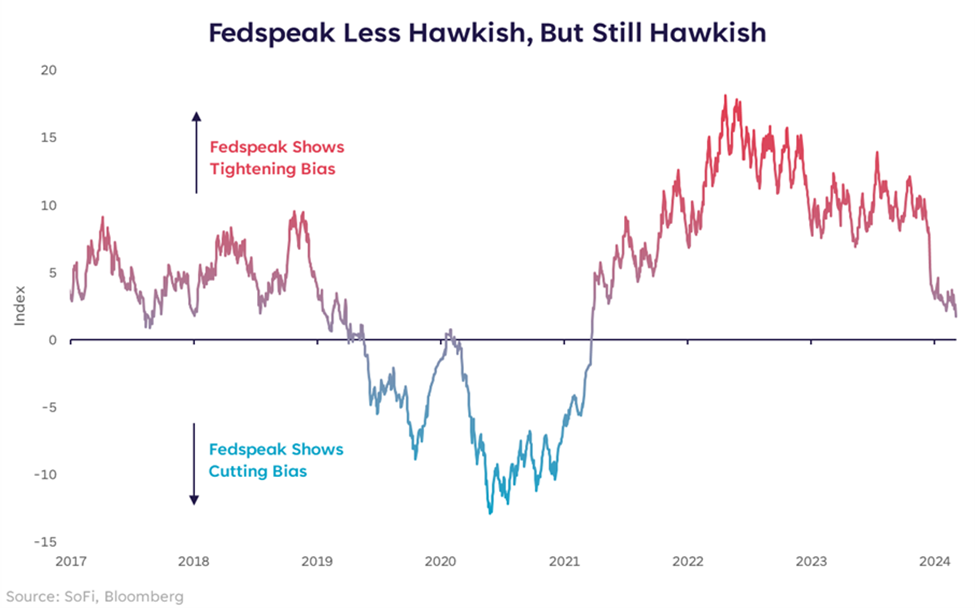

Considering that more than two-thirds of U.S. GDP comes from consumer spending, the health of the consumer will play a big role in whether these optimistic expectations are met. The availability of jobs, wage growth, and price pressures are some factors that affect people’s willingness to spend. Though demand has remained healthy, it has come off the boil from earlier in the cycle, not least due to the Federal Reserve’s interest rate hikes in its fight against inflation. While Fed officials have acknowledged that improvements in inflation data have been promising, they’ve indicated that they need to see more before they can begin to cut interest rates. And with stocks hovering near all-time highs, speculative corners of the market are growing stronger.

So long as the Fed maintains its hawkish stance, it will likely remain a key risk for both markets and the growth outlook. Markets are learning not to get ahead of themselves with rate cut expectations. Until the Fed signals a move toward normalizing interest rates, it’s hard to give the all-clear signal.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.